Brands launching into new markets: Here's how to set your brand growth targets

For challenger brands launching into new markets, one of the key focuses should be on raising brand awareness.

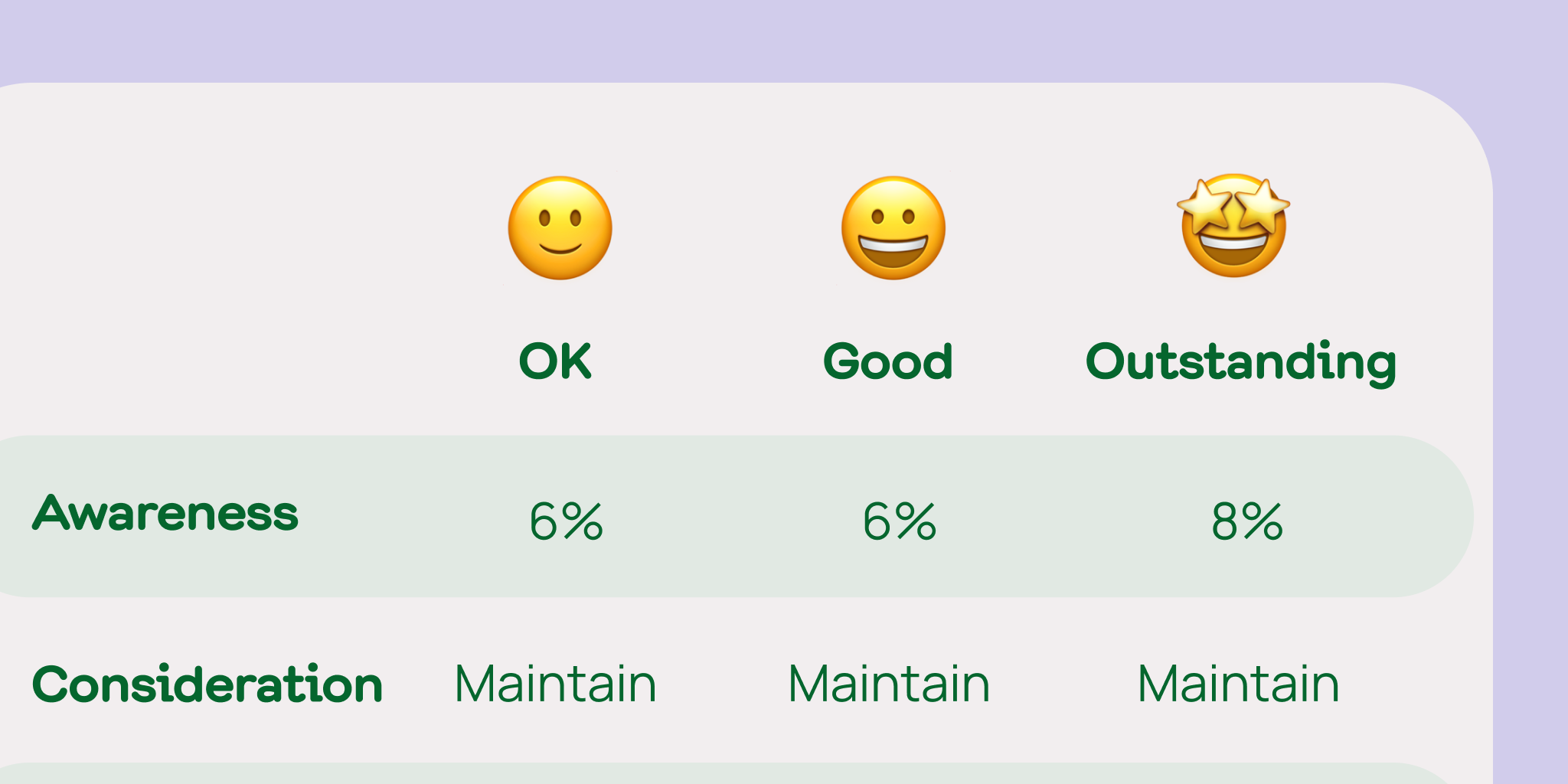

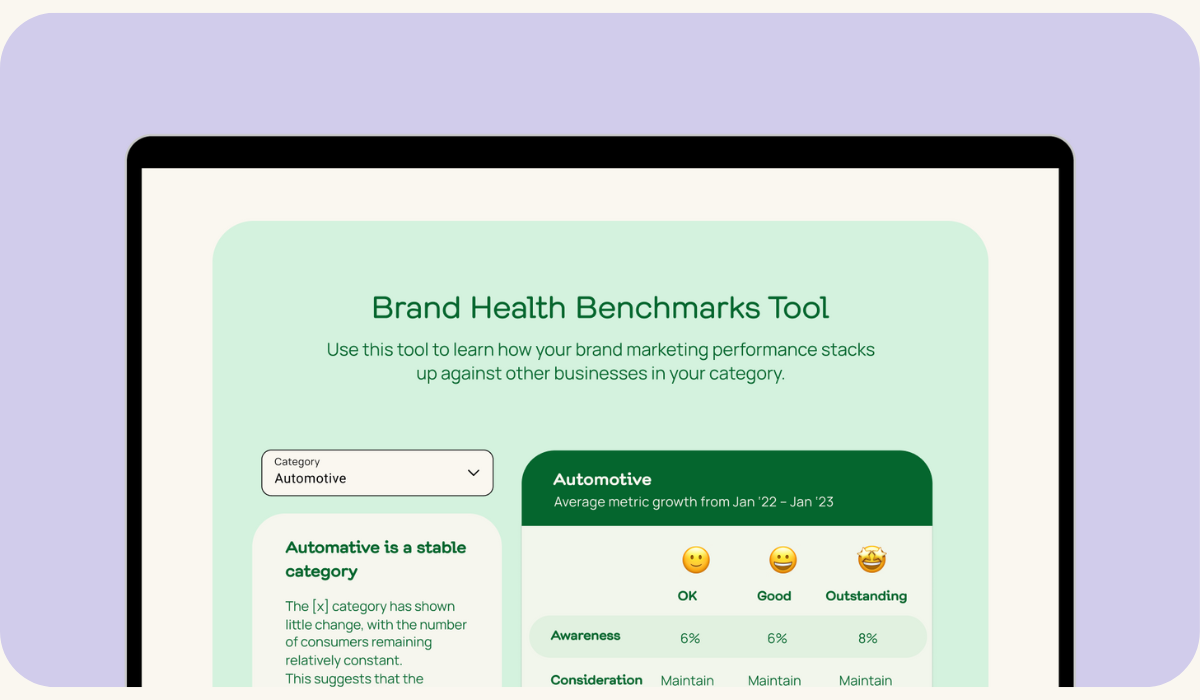

We often refer brands to our Brand Benchmarks Tool for them to understand how to set targets around brand awareness growth based on the current benchmarks for their industry. By using the tool, brands can see what growth as a percentage is considered outstanding, average and poor for their category.

By looking at the growth benchmarks for their industry, marketers can understand what aspirational levels of growth might look like in the year post launch. The benchmark tool might not be a crystal ball, but we’d say it’s worth at least a good pair of binoculars.

For new brands to market, the opportunity is especially ripe. If they can make a marketing splash with memorable media and effective channel selection, then they will most likely see rapid increases in brand awareness. In the coming years, these new-to-market brands can expect brand awareness growth to stabilize somewhat.

Sign up to Shorts

For fortnightly brand insights, stories and goodness that'll help you win (we promise).

Tying brand growth targets to investment 💸

Once you’ve got your brand benchmarks, you can set more informed targets, but it’s worthwhile relating this to an investment point of view. That is, how much will you expect to invest to attain this uplift in awareness?

To drop in a bit of good ol’ theory here, we often cite James Hurman (one of our co-founders) with the concept of Excess Share of Voice (or ESOV) so brands can understand how much they might need to invest to grow their brand.

We know a brand’s share of voice - that’s how much your brand spends on media as a percentage of the total media spend of those in your category - is approximately the same as its market share (%).

It has been well documented that brands who have a higher media spend as a percentage of their revenue than their market share, experience the corresponding growth. This is what we mean by ESOV.

To put it in (hypothetical) context: A challenger brand launches in a new market - say when Sephora launched in NZ in 2015. Within six months, if they have a market share of 6% but they are investing 10% of their revenue into media spend, then they can expect their market share to grow. With the NZ market seeing a disproportionately high amount of Sephora advertising across all media forms, they are able to grow their brand metrics and customer base.

Finding data on share of voice may not be the most straightforward for some brands as it relies on data that may not be available to them. But by making strong estimates of both share of voice and market share, brands launching in new markets can have a good indication of what level of investment they may need to grow.

To prove your brand growth, get tracking 🏃🏼♀️

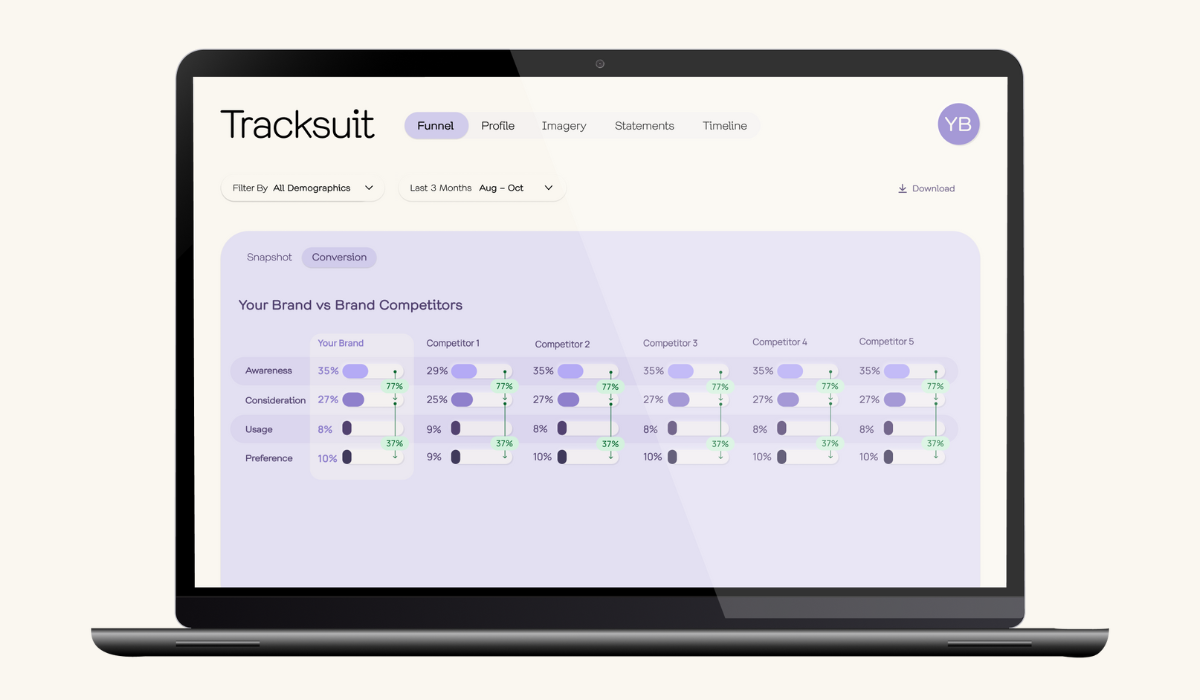

Numbers are just, well, numbers, unless you have context. In order to tie your targets to proven growth, and to track your progress against them, we recommend setting up an always-on brand tracker (nudge, nudge, we’d be happy to help in that department).

We’ve been lucky to work with fantastic brands across the US, UK, AU and NZ as they launch into international markets. We’ve seen some truly incredible shifts in brand awareness from these ambitious, challenger brands. All tracked on the beautiful Tracksuit dashboard, of course.

If you have any questions on the contents of article, or about brand tracking in general, please reach out to me at sargam.seelam@gotracksuit.com