Inside Poppi and Olipop’s rivalry: who’s winning 2025’s Soda Wars?

- Poppi and Ollipop have emerged as clear frontrunners in the “Better-For-You” soda category, with their rivalry only compounded by pretty frequent shade-throwing (mostly from Olipop’s side).

- Our brand health data shows that Poppi is pulling ahead, given a boost by its $1.5 billion-dollar acquisition by PepsiCo, announced in March 2025. Poppi’s awareness is 69% in the US, compared to Olipop’s 57%, and Poppi’s Preference is 29% compared to Olipop’s 18%. Interestingly, though, they have almost identical Imagery pages, meaning consumers don’t view them as very different from each other.

- The functional soda category is growing quickly, with countless new entrants this year. There are a few gaps in the market, namely with the male demographic, and the potential in bridging the gap between traditional sodas like Coca-Cola and healthy sodas like Poppi and Olipop.

Rivalries are irresistibly compelling narratives in all types of stories: from fairytales to romances to sporting teams to female popstars to, shockingly, prebiotic sodas.

In Tracksuit’s world, prebiotic sodas fall under the “Better-For-You” category, which basically includes all drinks that market themselves as just that: better for you, particularly against traditional sugary soda players like Coca-Cola and Fanta. They will usually contain some sort of probiotic or prebiotic that’s nutritious for the gut, be low sugar, and be accompanied by bright, poppy branding that appeals to the millennial-Gen Z generation.

The Better-For-You soda category has undoubtedly exploded in the past year. Coke entered the race with SimplyPop, for example, with dozens more smaller players putting their hat into the ring in 2025. According to Forbes, opens in new tab, the global functional beverages market size was valued at $175.5 billion in 2022 and is expected to reach $339.6 billion by 2030.

Sign up to Shorts

A fortnightly newsletter with exclusive brand insights, useful marketing tips, and a round-up of all the stories you should know about.

Two brands have emerged as clear frontrunners of the pack. Poppi and Ollipop, names that look pretty much like exact mirrors of each other, have experienced parallel growth, and are category-defining products that have successfully tapped into our modern wellness culture. They embody the quintessential product of now: Instagrammable packaging, irreverent marketing campaigns and brand voice, and, of course, added health benefits for functionality.

Both Poppi and Ollipop have achieved significant financial success. Poppi was acquired, opens in new tab by PepsiCo earlier in 2025 for $1.95 billion (and, despite this, Pepsi still launched, opens in new tab a prebiotic soda line of its own), and Olipop was most recently valued at $1.85 billion. See what I mean about rivalries being so compelling?

It doesn’t help that Poppi and Ollipop are often throwing shade at each other in the public domain – although, it must be said that Olipop are usually the instigators. In addition to Olipop’s infamous clapback, opens in new tab to Poppi’s Super Bowl vending machine controversy, in which they claimed that “those machines cost 25k each lol”, just a couple weeks ago, Olipop launched a tongue-in-cheek campaign, opens in new tab to promote its new Pineapple Paradise flavor, borrowing the iconic enemy-frenemy relationship between SpongeBob Squarepants and Plankton – positioning Poppi as Plankton, of course, who is releasing a new drink called “ChumPop”. The wars are still raging (to both their benefit).

So what does Tracksuit’s data reveal about these quote, unquote, “soda wars”?

It’s a two-horse race, and Poppi is currently inching ahead

In the Better-For-You soda category in the US, Poppi has pulled ahead when it comes to brand health. And although both brands have experienced similar growth trajectories, Poppi has had a mammoth 2025.

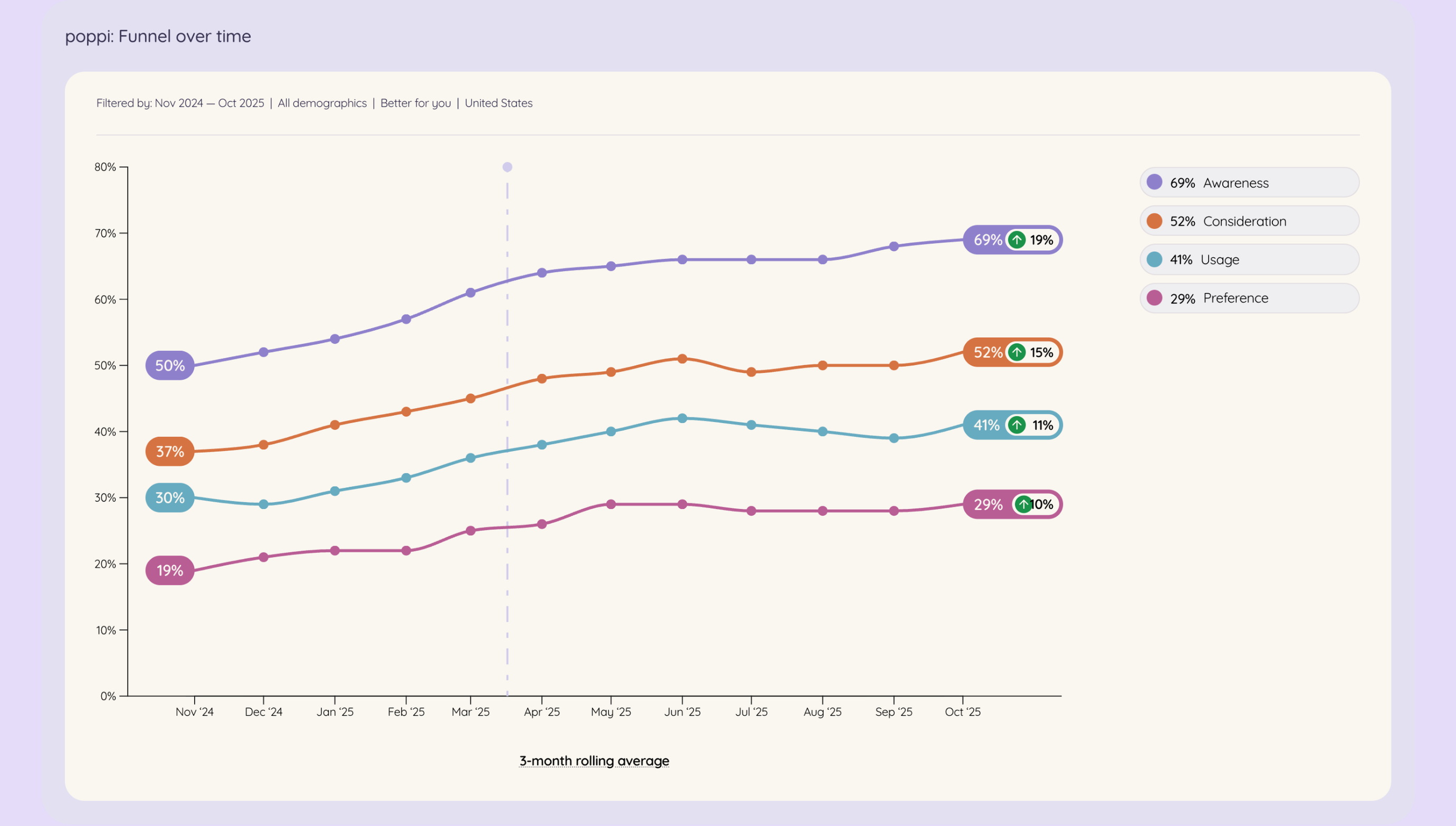

In the last year, from November 2024 to October 2025, Poppi has increased:

🟣 Awareness from 50% to 69% (19-percentage-points)

🟣 Consideration from 27% to 52% (15-percentage-points)

🟣 Usage from 30% to 41% (11-percentage-points)

🟣 Preference from 19% to 29% (10-percentage-points)

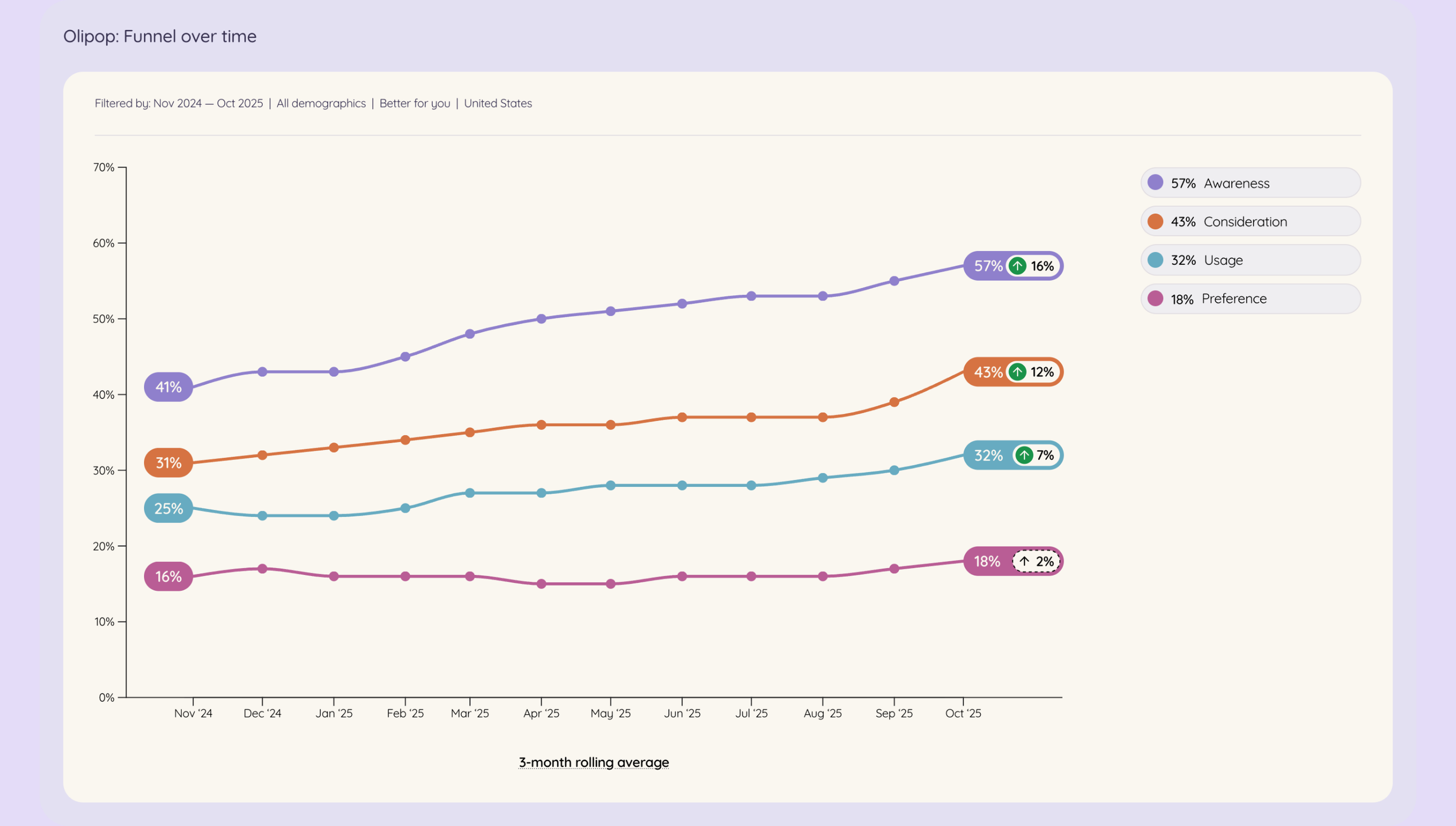

In the same time period, Olipop has increased:

🟡 Awareness from 41% to 57% (16-percentage-points)

🟡 Consideration from 31% to 43% (12-percentage-points)

🟡 Usage from 25% to 32% (7-percentage-points)

🟡 No significant shift in Preference, which is currently at 18%.

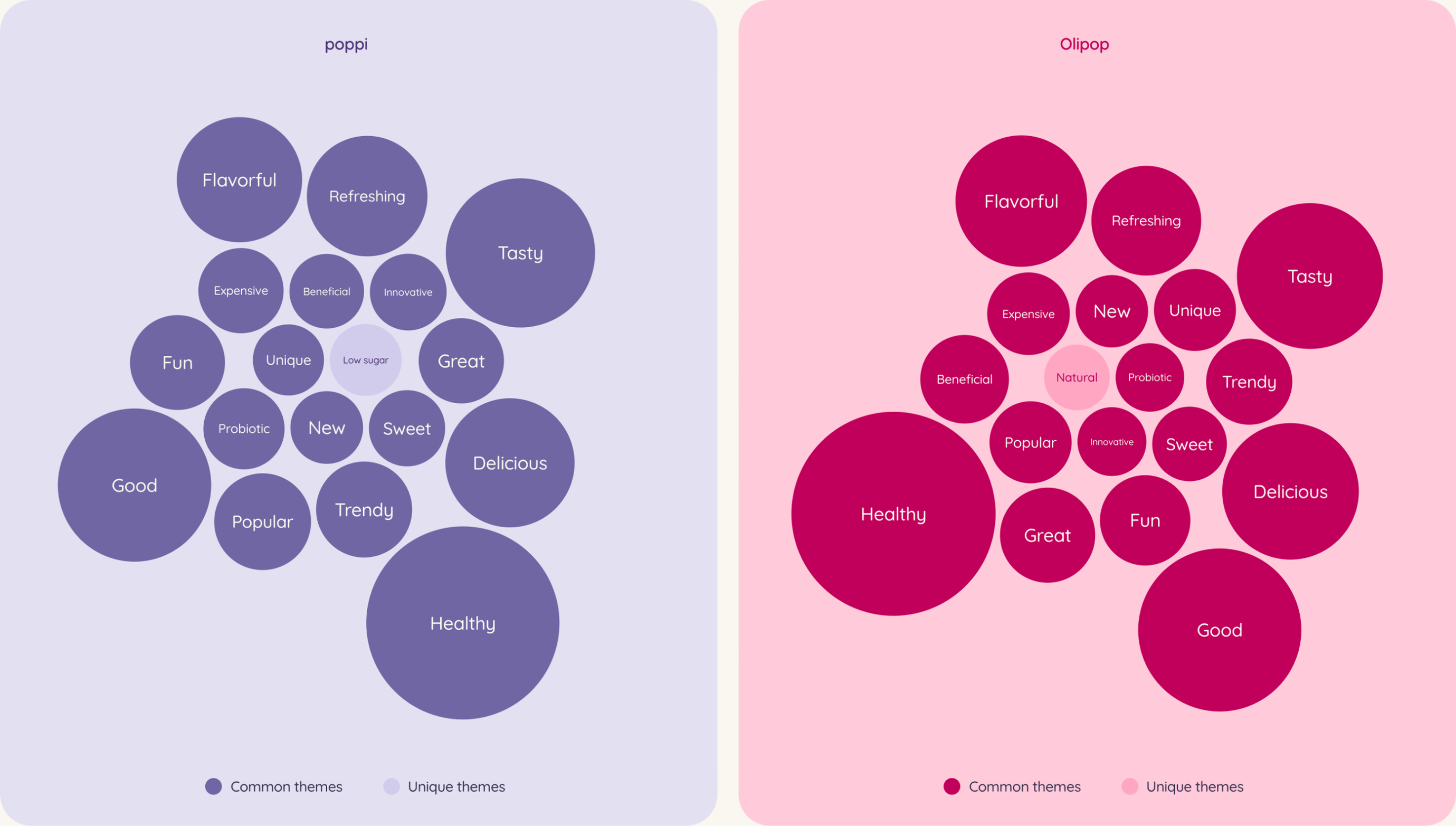

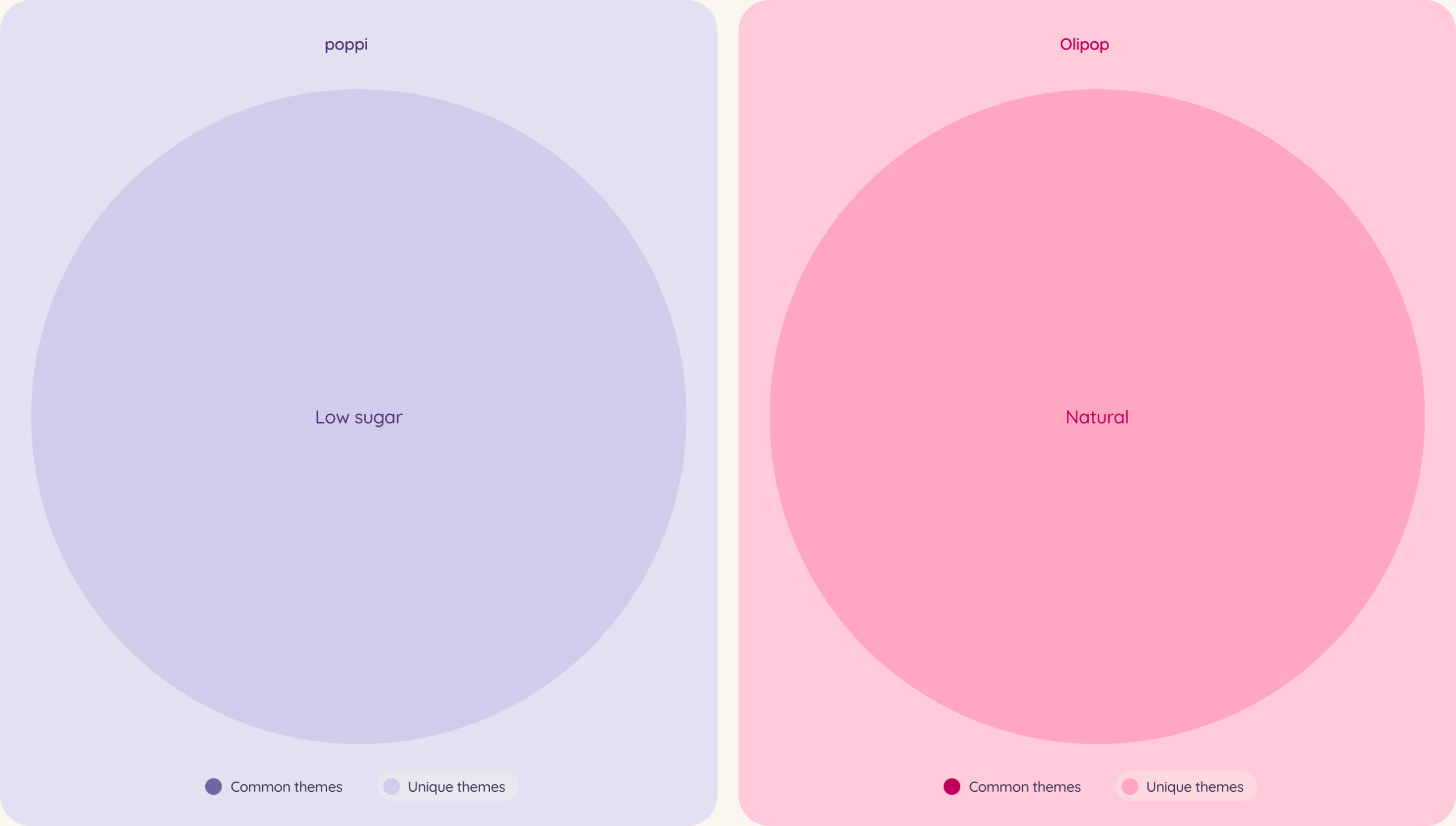

Poppi and Olipop have an almost identical Imagery page, meaning that when asked what they associate with each brand, consumers have very similar feelings. Amongst the common themes are “Healthy,refreshing, trendy, probiotic”. The only two unique themes? “Low sugar” for Poppi, and “Natural” for Olipop.

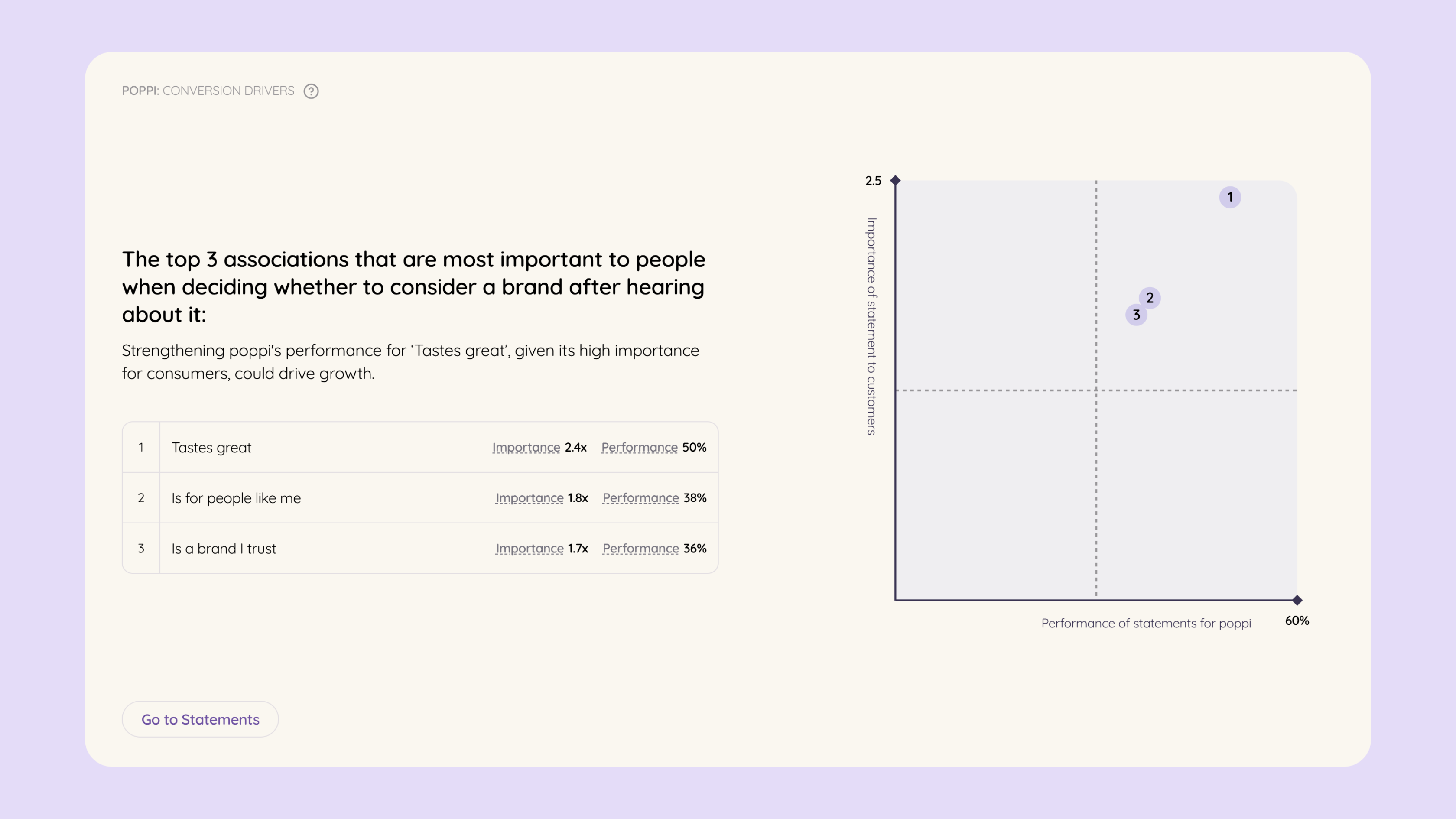

The two brands also achieve similar results in our Statements page, which evaluates the percentage of consumers aware of the brand that associate it with perceptions like “Is a brand I trust” and “Tastes great”. This page allows you to understand what’s resonating with customers and how your brand performs on important category entry points.

There are not that many unique themes differentiating the two brands.

So why could Poppi be winning?

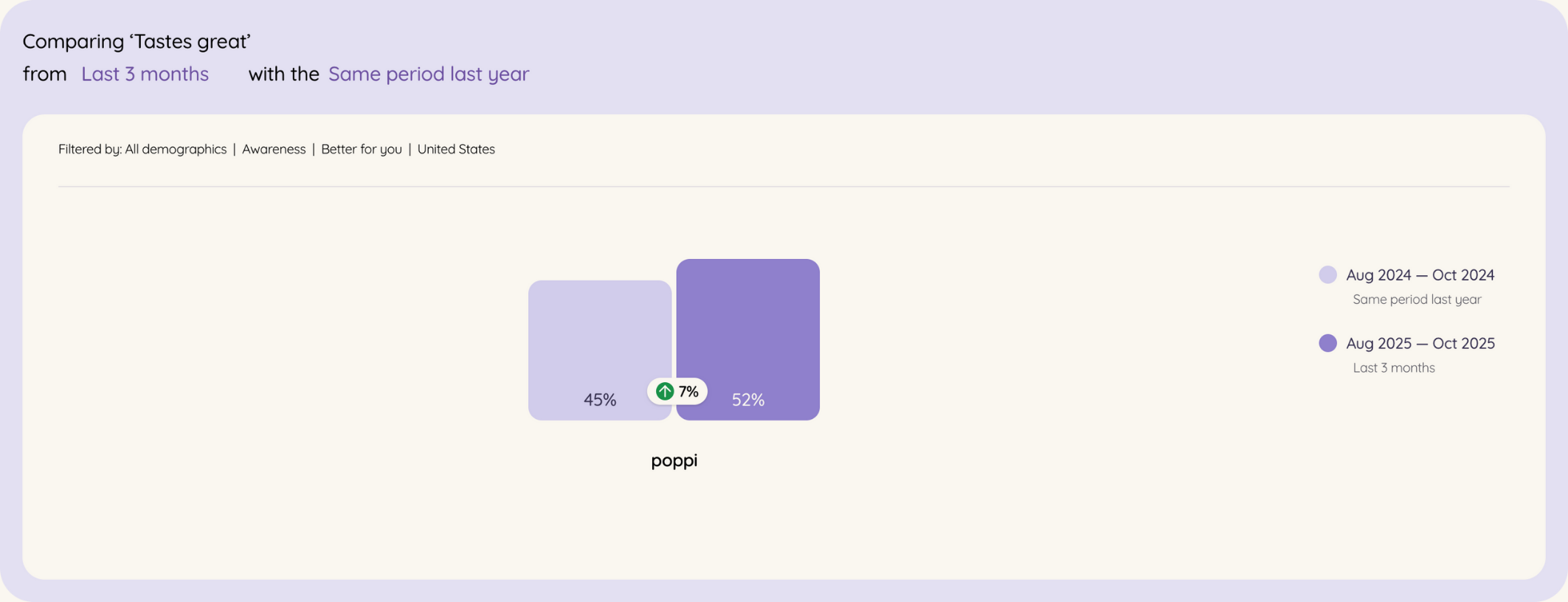

Although Poppi and Olipop perform similarly with Statements, we can see that Poppi’s performance in “Tastes great” has increased significantly in the past year compared to Olipop. Poppi’s increased 7-percentage-points in this Statement when comparing the last 3 months to the same period last year, while Olipop didn’t experience a significant gain.

This is a notable shift, especially as “Tastes great” is the number one conversion driver in this category. It’s 2.4x more likely to convert people down from Awareness to Consideration.

When it comes to how both brands are showing up in the market, both brands lean heavily into social influencer marketing, collaborations and celebrity campaigns, although Poppi is generally more recognized for adopting an influencer-first approach at launch. That’s in contrast to Olipop’s more retail-first launch strategy, where they expanded into physical stores earlier in its journey.

Probably one of the biggest marketing differences, though, is how each of these brands position themselves. Even though they may look like overlapping venn diagrams, there are deviations in positioning and message that could have had a compounding effect on brand performance.

Poppi was interested in defining the category right from the beginning (“the future of soda”), with its messaging focusing on translating its product into a lifestyle, with a clear fun-forward perspective. Think: merch, events, distinctive pink branding, college sorority partnerships.

Olipop leaned more into emphasizing its functionalities, namely through highlighting its health benefits such as its additional prebiotics and fibre (which is, technically, much higher than Poppi’s). Though this has changed somewhat (for example, Olipop recently ran a celebrity campaign which capitalized heavily on the power of nostalgia and love of soda, below), it takes a long time, and a lot of effort, for perception to shift.

OLIPOP Soda Story - Joshua Jackson

Poppi’s also had a couple of more controversial marketing moments this year which stirred up plenty of debate in the public consciousness. Take Poppi’s divisive Super Bowl commercial, for example, which saw them gift vending machines to 32 creators, opens in new tab prior to the commercial airing (which featured influencers like Alix Earle and Jake Shane). Countless TikToks were made about overconsumption, criticizing the brand for splashing cash around in a way that might have read as “wasteful”. This happened shortly before Poppi announced its acquisition by Pepsico. The saga also threw fuel to the fire on Olipop and Poppi’s rivalry – Olipop was regularly seen in the comments clapping back.

It’s far from the first time a controversial marketing play has worked in the brand’s favour (the American Eagle x Sydney Sweeney ad, opens in new tab is one of the most notable examples that happened this year). We can see that Poppi’s awareness rose 7-percentage-points between February ‘25 and April ‘25 (post SuperBowl controversy). Consideration rose 5-percentage-points in that time, too, meaning they weren’t just building awareness via controversy, but converting those people into considering buying Poppi, too.

What are the gaps in the market?

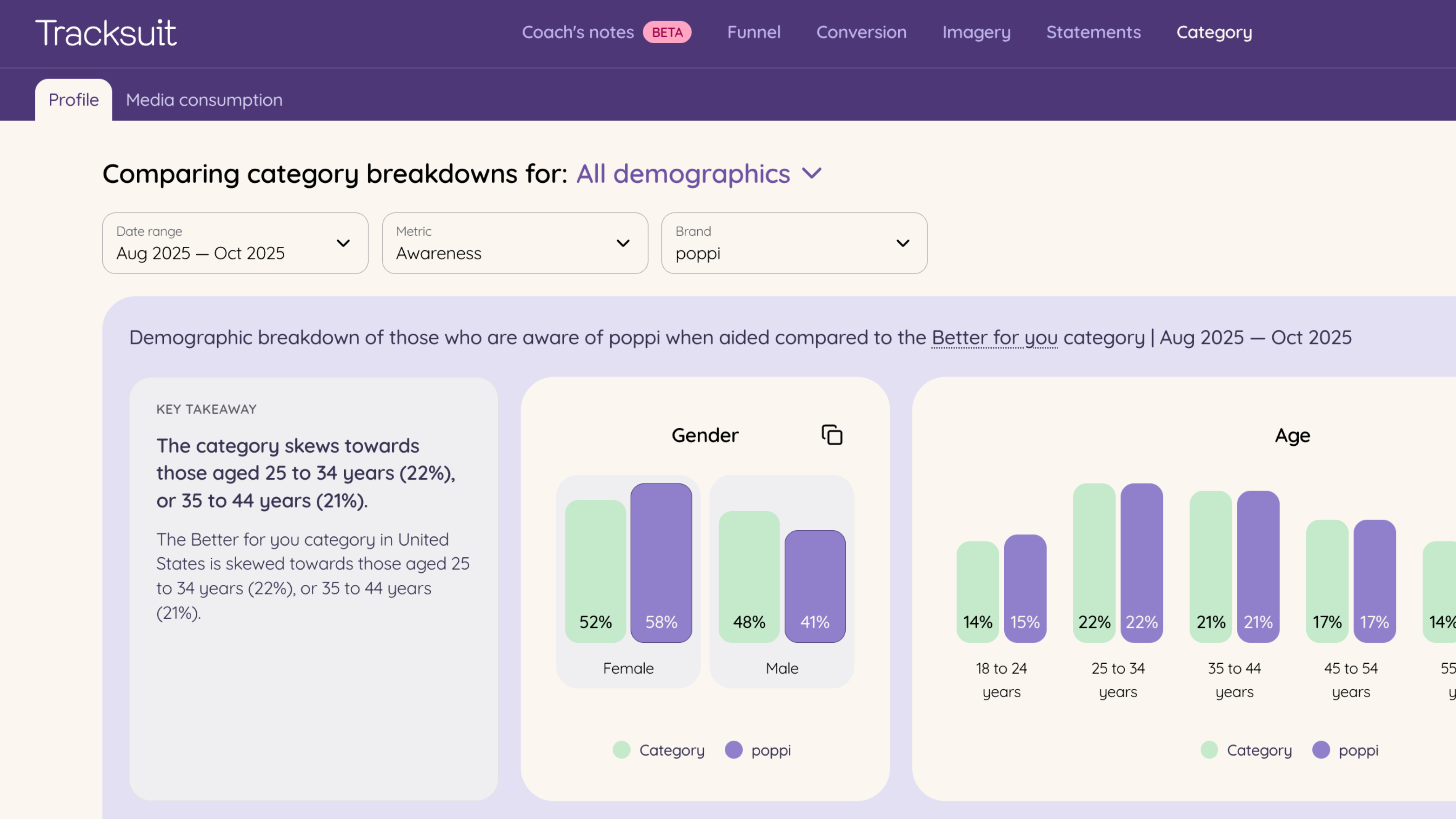

According to Tracksuit data, both Poppi and Olipop are underindexing on males in the category. This basically means that although the gender make-up is more or less an even split (48% male), Poppi’s only reaching a 41% male audience, and Olipop is only reaching a 40% male audience. The only brand we track in this category that is meeting the 48% male audience is Culture Pop. We know that Olipop is trying hard to crack this demographic via a partnership with Shanked, a creator-led scripted golf comedy on YouTube to reach everyday male golfers (golf is, inexplicably, a key category entry point for drinking soda).

Perhaps the most obvious gap, however, is the space that exists between traditional sodas and functional sodas, considering how many people are regular soda drinkers. That’s something that Olipop identified with its nostalgia campaign, which features celebrities reflecting on their childhood love of sodas, but become more health conscious as they grow older. Olipop allows them to be “healthy” without sacrificing their soda cravings.

When we look at the traditional soft drinks category that we track in the US, which is a much bigger category, we can see that Poppi has a 38% awareness, and Olipop a 31% awareness. These brands also have much lower conversion rates in this category (makes sense), with Poppi converting from awareness to consideration at 32%, compared to Coca-Cola at 76%. This shows that it’s obviously much harder to sway soft-drink consumers into trying something different, especially something positioned as healthy.

We saw other new entrants, like Ben Stiller’s offering Stiller’s Soda, opens in new tab, position itself as trying to bridge this gap, with added vitamins and less sugar, but delivered via a very traditional-looking soda can and flavour. It’s perhaps trying to capitalize on “better-for-you” fatigue, which, I think, is coming shortly: a collective consumer fed up-ness with added protein and prebiotics and the like.

However, things could swing right the other way, with more and more brands switching up the “type” of better-for-you additives they can put into drinks: THC, adaptogenic mushrooms, botanicals, protein. The list goes on.

Let’s just hope the bubble doesn’t pop.