Is Puma actually winning over Gen Z?

- Puma launched its first global brand campaign in a decade in 2024, and followed it up with an even bigger one in 2025 (“Go Wild”), which pivoted messaging from high-performance athleticism to everyday self-expression.

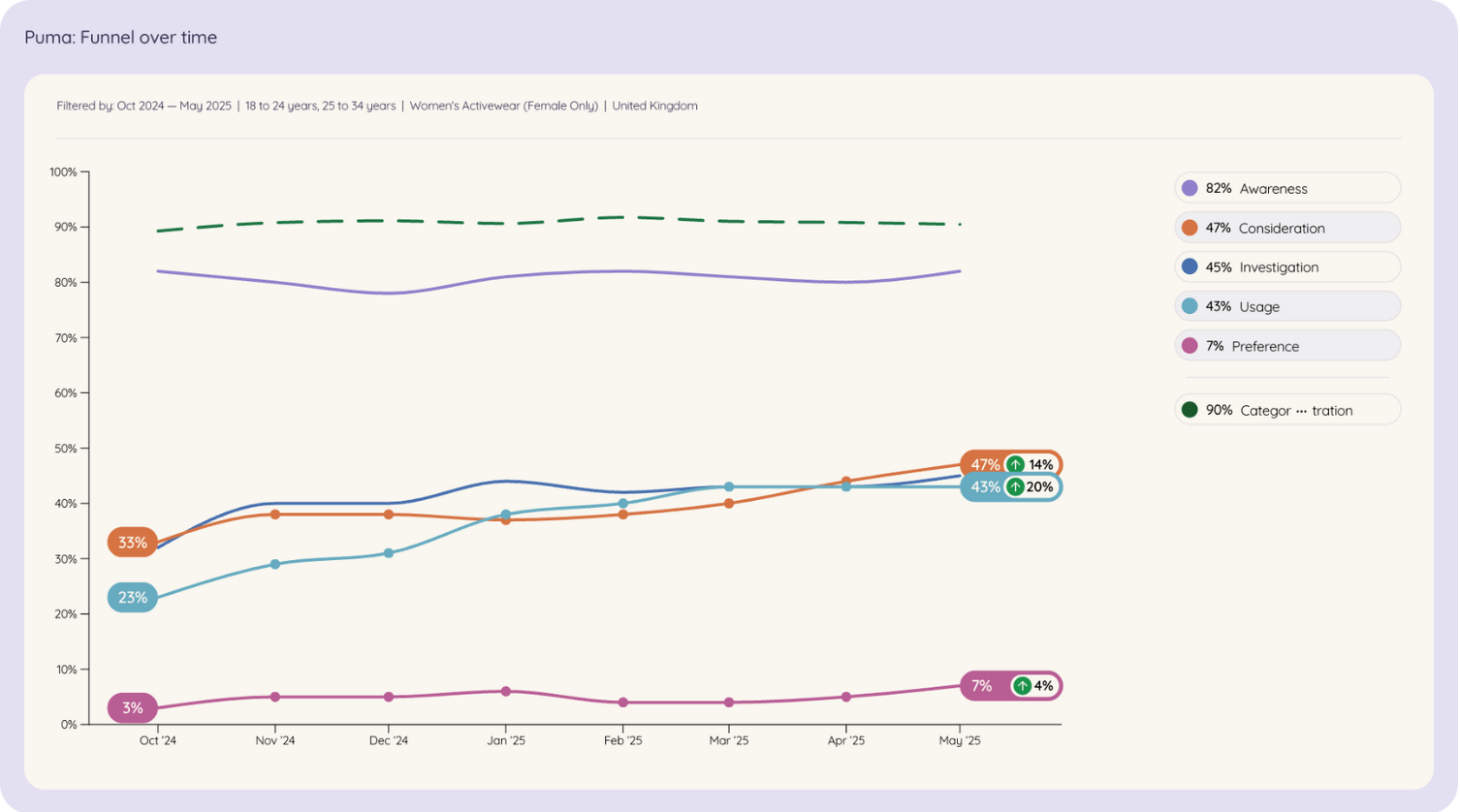

- Tracksuit data shows that this has impacted Gen Z women in the UK, with Consideration lifting 14-percentage-points from Oct ‘24 to May ‘25, and Usage jumping 20-percentage points.

- However, we’re not seeing this reflected in all markets, with no significant changes in the US, suggesting that its messaging isn’t resonating globally. Sales have also been flat in 2025.

It’s not easy to stand out as a sportswear brand. First, there’s some very big players – Nike, Adidas, Under Armour – that take up a lot of the space. Secondly, there’s a tonne of innovative challenger brands nipping at their heels, like Hoka, On, Vuori, Salomon. And, thirdly, sportswear ads and messaging can look and feel the same. There’s only so many ways you can manipulate athletes and regular gym-goers winning, sweating, huffing, stretching and running marathons before consumers start to get numb to it all.

For the last few years, Puma has been falling behind. At the end of 2024, for example, its shares fell 20% after profits came in under projections. Its cultural relevance lags behind its closest competitors, like Nike and Adidas. (Think, for example, the success of Adidas’s lifestyle sneakers like the Gazelles and Sambas, or its high-fashion collabs with brands like Y3.) Puma doesn’t even really have a horse in the It Girl shoe race (except maybe the Speedcat Ballet Sneakers, opens in new tab), and its lack of stylistic perspective has meant emotional relevance and connection has been a serious problem for the brand.

A new era

In 2024, Puma launched its first global campaign in a decade – “Forever. Faster. See the Game Like We Do, opens in new tab” – which unified its messaging across all sports, and intended to position Puma as a product that helped athletes achieve high performance. It featured a handful of sports stars, with the ads leaning right into that slow-mo, inspirational-music, cheering-crowd visual imagery that we as consumers are intimately familiar with. Puma claimed that brand perception had “improved, opens in new tab” as a result, but it was still doggy-paddling in a very competitive landscape, the aspirational messaging not quite landing with everyday consumers.

In March 2025, it pivoted, and one-upped its 2024 attempt with an even bigger global marketing campaign: “Go Wild, opens in new tab”. Produced by agency Adam&Eve, Go Wild focused more on the everyday athlete – the people just trying to walk their dogs, struggle up steep hills, and make social connections at run clubs. Why? According to Puma’s own marketing research, opens in new tab, the “performance at any cost” messaging wasn’t really resonating with Gen Z. They were more interested in the idea of “self-expression”, which, in this context, I think is rooted in the idea of relatability. (Interestingly, Nike just announced, opens in new tab that it would be shifting away from lifestyle marketing and focusing more heavily on athlete-forward storytelling.)

This campaign is no drop in the bucket for the brand. Puma is upping its marketing investment by 40% in 2025, and Go Wild represents the largest global campaign in the brand's history that's being amplified across digital, out-of-home, PR, social, TV and retail.

In 2025, our brand data shows that Puma is building pace with Gen Z women… in the UK

So, is the major investment paying off already? The tide could very well be turning, and its brand marketing efforts have not gone unnoticed. In fact, in the UK, Puma has seen very significant increases in its brand health metrics from Oct 2024 to May 2025.

Among 18-35 year olds women, from Oct ’24 to May ‘25:

- Consideration has increased 14-percentage-points sitting at 47%.

- Investigation has lifted 13-percentage-points sitting at 45%.

- Claimed Usage has jumped 20-percentage-points sitting at 43%.

- Preference has also significantly increased 4-percentage-points sitting at 7%.

The brand has also become more effective at converting awareness into consideration. Among the same age group, its top-of-funnel conversion rate has risen by 17-percentage-points from 40% to 57%. This is in line with the category average.

So is Puma actually winning over Gen Z? The answer is complicated. We’re seeing that these results vary across markets, including in the US, where these changes have not been reflected in the US market. There has been no statistically significant changes in the same time period in the US, except for a 3% decrease in preference.

So could Puma’s new messaging be resonating in certain markets and cultural contexts more than others?

Sign up to Shorts

A fortnightly newsletter with exclusive brand insights, useful marketing tips, and a round-up of all the stories you should know about.

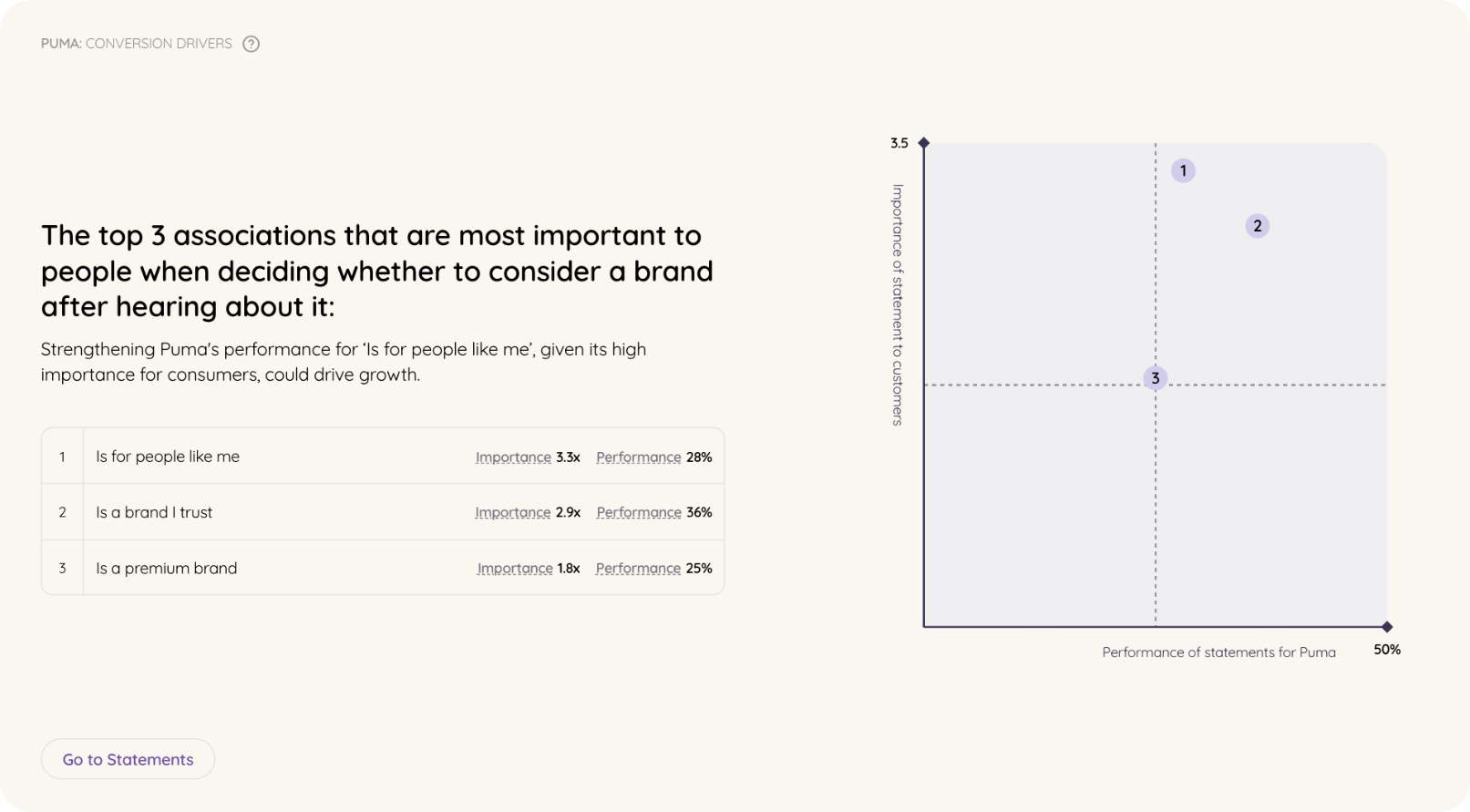

‘Is for people like me’ is the biggest driver down the funnel

No surprises here. Puma found in their own research that self-expression and relatability mean the most to their audiences, and our research only backs that up. Puma needs to continue to focus their marketing efforts on emotionally connecting with target audiences, like Gen Z, because as we’ve seen time and time again: the biggest converter down the funnel is the statement ‘Is for people like me’.

Basically this means that if someone in this category thinks a brand is for people like them, then they are 3.3x more likely to convert down from awareness to consideration.

Where does Gen Z hang out?

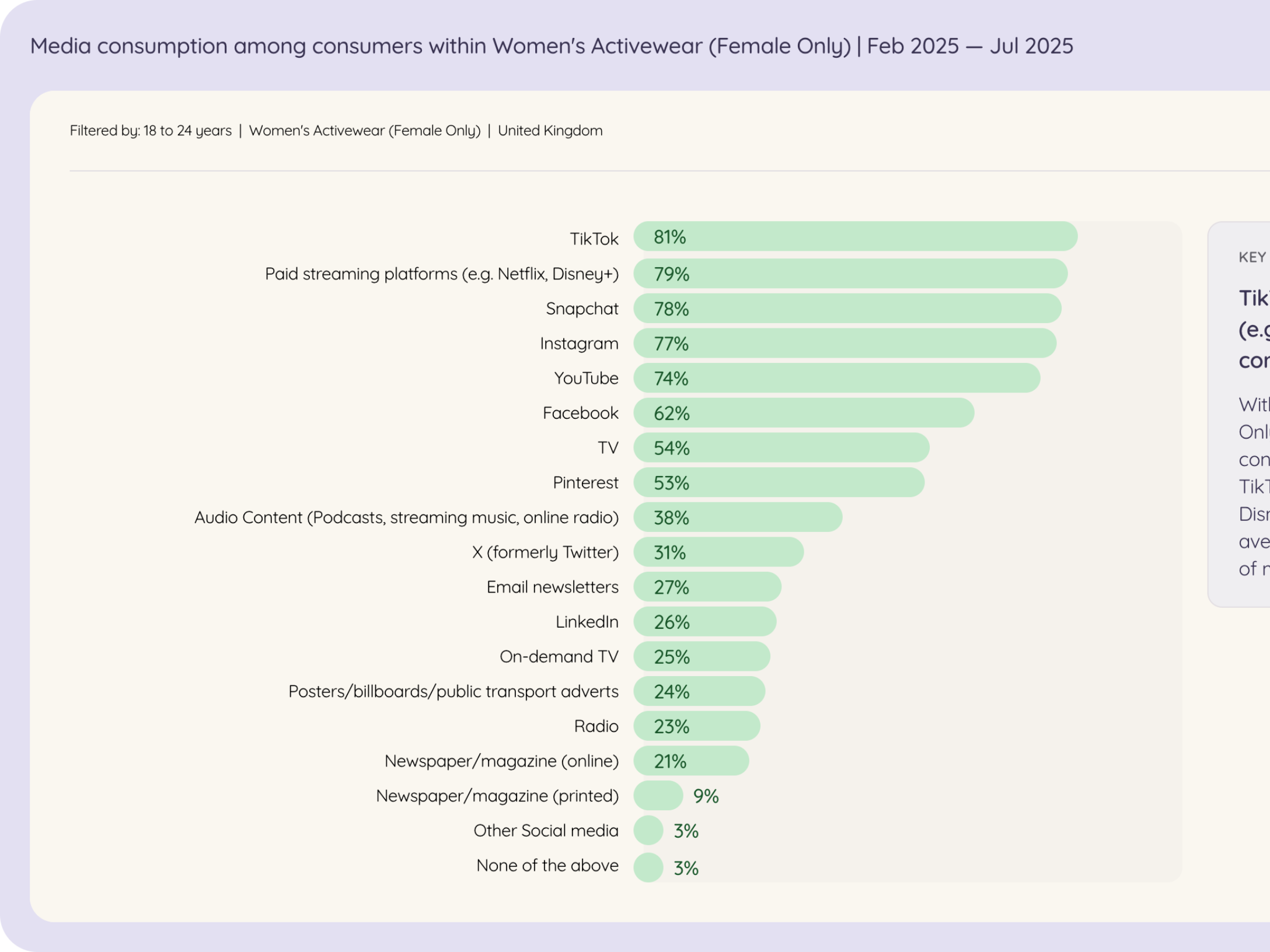

Tracksuit's new Media Consumption report shows that the 18 to 24 year old age group in this category overwhelmingly spend their time on TikTok; that's the number one most consumed platform amongst those of this generation.

This is followed by Paid Streaming Platforms and Snapchat – a top three that differs significantly from other demographics.

This shows that if Puma is wanting to drive category growth with this audience, it should be considering upping its presence on these top platforms.

Should they even be going after Gen Z?

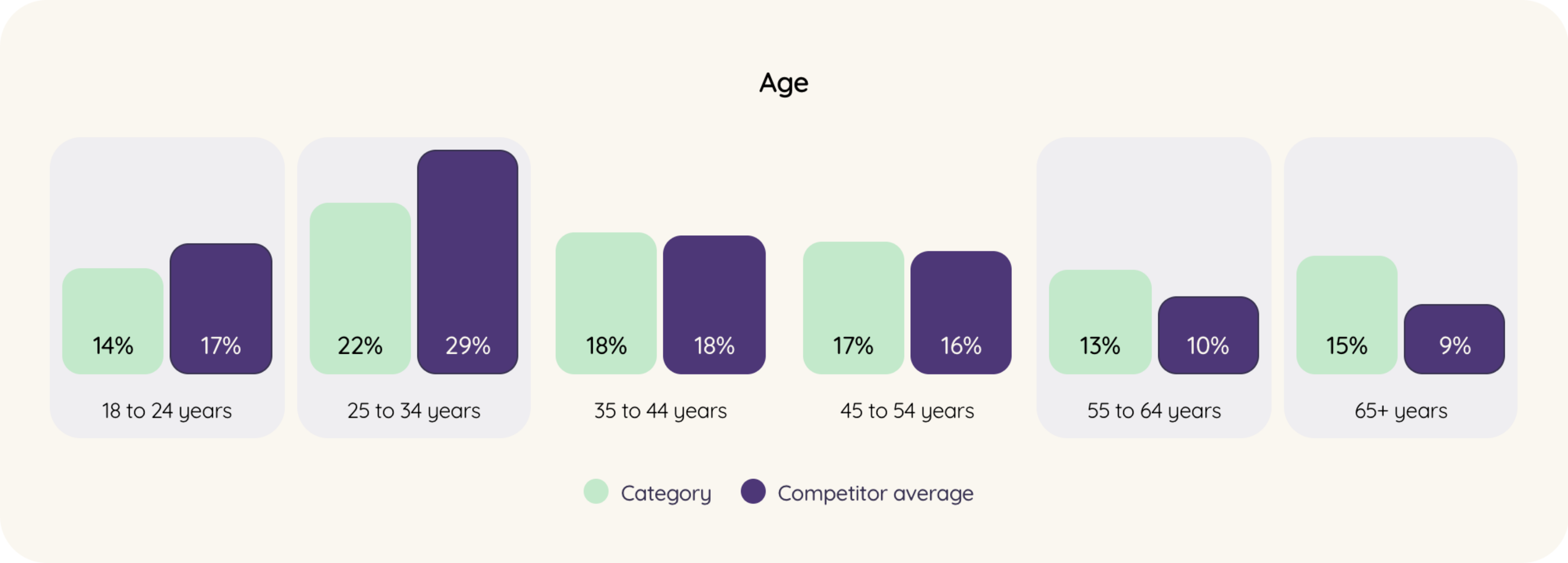

While the benefits of targeting a younger generation are obvious – brand loyalty takes a long time to build and can last a lifetime – our Category Profile page shows that brands in this category do over-index in the 18 to 24 and 25 to 34 year old age groups (when filtered by awareness).

Our data shows the whitespace can be found in the 55 to 64 year old age group.

Puma still has a way to go yet to see brand efforts reflected in sales

Puma had reported to be missing sales and profit expectations, opens in new tab (according to some reports, this is partly due to some ranges, like the Speedcats, not doing as well as they thought). However, as we know, brand is a long game, and it may take some time to see the results of brand investment. We’ll keep an eye on it for you.