The changing face of wealth management, and the brands leading the charge

The wealth management industry is changing 💸 And we’re not just talking about external factors like rising inflation, but the demographics of consumers who are engaging with the space.

Traditionally, roughly two thirds of private wealth in the United States has been held by people over 60., opens in new tab But that’s no longer the case. Young, diverse investors have entered the space, and they’re transforming the landscape to be more inclusive — which we’re all for!

Sign up to Shorts

For fortnightly brand insights, stories and goodness that'll help you win (we promise).

Tracksuit’s unique data shows that 15.7 million people in Australia were active in wealth management in May 2022, which means they’ve invested in a savings account, term deposit, managed fund, or shares.

A year later in 2023, it reached 16.2 million. 7.9 million women — or 78% of the female population — were active in the industry, highlighting the increase in inclusion.

This is also spread across age groups: two million consumers in Australia active in the wealth industry are aged between 18 to 24 (clocking in at 90% of the demographic, the highest percentage across the spectrum). While it remains high for the 3.4 million active consumers over 65 (coming in at 81%) it’s also high for every demographic. The 55 to 64 demographic, which is the lowest across the spectrum, is 73%.

Put it this way: wealth management is a stable category, and it’s here to stay.

As wealth changes hands, new investment opportunities arise. As such, brands active in asset and wealth management need to stay on their toes and be aware of the latest trends affecting their sector. Without proper trend and brand research, it’ll be harder for your company to thrive.

Don’t know where to start? In this article, we’ll break down the top trends in wealth management in 2023, and provide guidance and how to stay ahead of the curve. Let’s dive in!

Top trends in wealth management

1. Women investors are leading the charge 👩

As we mentioned in the intro, wealth management is starting to become anyone’s game. But what’s led to this change?

Let’s start with female investors. Women are becoming wealthier and they currently own one-third of the global private wealth, opens in new tab. Plus, more women are working professional jobs, allowing them to build their wealth through entrepreneurial endeavors, which stands to reason why they’re moving up economically.

Generational wealth transfer also plays a key role: younger people are often the main beneficiaries of wealth transfers. Baby boomers have a combined asset pool of US$ 30 trillion, so we’re likely to see that start to trickle down to Millennials and Gen Z.

What’s more, general economic uncertainty has led to many focusing on ways to ensure a financially comfortable future. This often involves looking for better jobs with higher salaries, but can include discovering ways to grow one’s current wealth or better manage it.

Finally, there’s a growing interest in managing wealth, with movements such as FIRE, opens in new tab (Financial Independence, Retire Early) gaining traction worldwide and partly contributing to the rise of mass affluent households. With nearly one-third of millennials starting to invest before 21, opens in new tab (as opposed to just 9% of baby boomers), younger generations are a rising force in investing.

So while there are plenty of opportunities on the rise, many wealth management firms still cater to the traditional face of wealth management, leaving women and other demographics underserved.

2. More socially and environmentally responsible investment options 🌳

Sustainability and corporate social responsibility are also making waves in the investment realm.

There’s been a sharp uptick in the demand for environmental, social, and governance (ESG) investment products globally: it’s projected that ESG-backed assets could swell to a stunning US$ 50 trillion by 2025, opens in new tab, comprising a third of all managed assets globally.

Much of this has been pushed by the growing interest of Millennials and Gen Z’ers in more responsible investment alternatives.

With younger generations more acutely aware of the very real impact of climate change, they’ve started to invest accordingly — and it’s been a sizable impact. In the U.S., investors contributed US$ 51.1 billion, opens in new tab in ESG-backed funds in 2020, a sharp increase from less than US$ 5 billion in 2015.

As wealth continues to change hands, it’s likely that more standardized ESG regulations will be introduced and enforced globally, with more parties centering ESG as a critical investment objective.

3. Continued rise of digital wealth management tools 💻

Assets managed with robo-advisory services are expected to hit US$ 16 trillion by 2025, opens in new tab. Robo-advisers are becoming popular in part because of their accessibility and affordability. There are also benefits for partners: labor-intensive processes can be automated and digitized, freeing up valuable time that can be spent building relationships and managing clients’ investments.

Customers are starting to expect this from firms as well: nearly 80% of North American financial relationship managers, opens in new tab lost business due to not having digital tools in place to work with clients when in-person meetings weren’t allowed during the pandemic. While COVID-19 may not be a pressing issue anymore, digitisation will be the name of the game for successful wealth advisors.

How can wealth management businesses stay ahead?

Now that we’ve looked at some of the key trends shaping the investing world, how can your wealth management brand stay ahead of these emerging trends to gain a competitive edge?

1. Embrace inclusivity 👐

As a diverse range of demographics gets into wealth management, financial advisors and asset managers must cater to their needs and preferences to stay relevant. By matching the paradigm shift, brands can effectively (and honestly!) connect with a new generation of investors.

One example we love is Ellevest, opens in new tab, which boldly differentiates itself from the competition straight from their slogan “Not your dad’s financial advisor.” By focusing on online and alternative investing and clearly underscoring the optimization for women’s wealth (with social proof to boot), Ellevest clearly embraces inclusivity and stands out from the crowd.

2. Offer ESG-backed investment options 💰

If you aren’t offering ESG-backed investment options, it’s high time to do so.

That said, be sure to avoid greenwashing. As sustainable investing continues to grow, disclosure gaps will be highlighted, so regulators will start implementing standardization to protect investors.

Make sure you truly embed CSR and ESG products into the DNA of your business. Your customers can sense inauthenticity, and greenwashing can lead to serious reputational risk down the road.

Take Pathfinder, opens in new tab, a New Zealand-based asset manager that exclusively invests in ethical investments. Not only did they start investing in ESG-backed products before it was cool, they’re committed to full transparency on their ethical investments, weaving it through their entire brand identity and story.

3. Invest in brand and use data analytics to monitor brand performance 📈

From consumer behavior and preferences to specialized market trends, there’s a wealth of data specific to your sub-niche or organization your brand can (and should!) track.

With tools like Tracksuit, you can easily measure how your wealth management brand is performing. It’s custom-tailored to your competitors and target audience, allowing you to deeply understand what your target audience thinks and feels about your brand, which you can then translate into actionable insights.

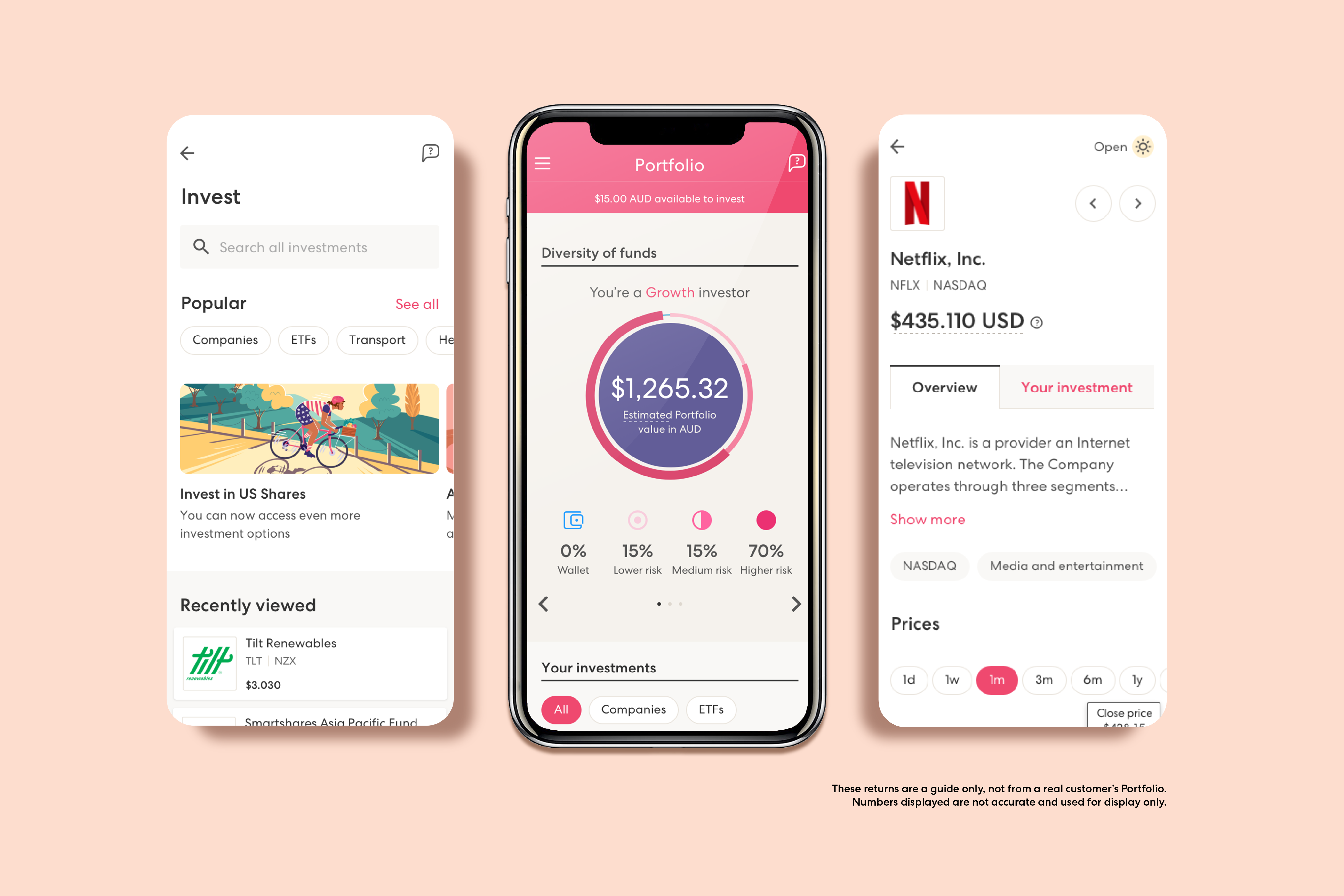

Data-driven insights are a great way to identify and track new product opportunities. Sharesies, opens in new tab recently expanded its product offering beyond investing in shares to include offering a savings account and a Kiwisaver (superannuation) scheme is coming soon for their customers.

Sharesies Head of Marketing Australia and New Zealand Rachel Beange says the brand has now shifted its identity to be a wealth app rather than an investing app. To map how people’s perceptions of this change over time, Sharesies has been using Tracksuit’s Statements feature to see how many identify it as that.

According to Tracksuit’s data, Sharesies is ranking at the top of their category for the statements ‘Offers a range of products to grow your money regardless of life stage’ and ‘Offers a high-interest savings account with no minimum deposit and no restrictions’.

“We’ve been pretty blown away by the response to the new Savings product,” Rachel says. “The wait list was bigger than we could have hoped for and launch sign up numbers have been massive. On Tracksuit we're already starting to see some movement in how people understand our brand and how people are aware of the new products we’re offering. It's great to know our marketing campaigns are having the desired impact.”

Tracksuit can also be used to track performance results like brand-building campaigns, messaging strategies, and overall marketing efforts.

Tracksuit customer Kernel Wealth did just that. After running a brand campaign, they used our insights to show they were the only business among their competitors to almost triple brand awareness over that time period.

“Through Tracksuit’s various pieces of data, we’re able to communicate with our wider team the value of brand-building, plus identify opportunities with new audiences, locations or additional messaging that might resonate with our target customers,” Marketing Manager Christine Jensen says.

4. Provide comprehensive financial education 📚

A great way to provide real value as an investing platform is by empowering your clients with the tools and knowledge they need to make informed investment decisions. Investing in providing knowledge resources can help cement your brand as a thought leader, which will help draw in more customers in the long run. From providing analyzes of financial news to providing explainer blog posts on common investing terms like ETFs, there are a range of possibilities you can use.

Need some more inspiration before getting started? We love Fisher Fund’s News & Insights section, opens in new tab, which provides a great mix of truly helpful resources.

The finishing line 🏁

The tried-and-true approach that many wealth management companies have followed for decades is becoming less relevant. Make sure you don’t get left behind by adapting your business model ASAP to meet the shifting landscape. While a business-wide strategy is important, from a marketing perspective, it’s important to adopt a solid brand tracking strategy.

Tracksuit provides brands with actionable insights that show you what your (potential) customers think about your brand through affordable, always-on brand tracking, which makes it easy as pie to clearly demonstrate your marketing ROI. It takes just 30 days to take a deep dive into how your customers perceive your brand (and competitors!) and we’ll do all the work of surveying thousands of people weekly. All you need to do is fill out a questionnaire and wait for the insights to start rolling in.

Find out how your business is performing against your competitors in wealth management and start leveraging the data by requesting a Tracksuit demo today.