The Rise of the Skincare Market: What’s Next for Beauty’s Latest Frontier?

In case you hadn’t noticed, skincare has quickly become the “it” product category. In 2018, skincare sales grew by 13%, opens in new tab YOY, while makeup grew by just 1% during the same period. Put simply, the past few years have seen a significant shift in how beauty brands are thinking about skincare — and how to sell it to an increasingly knowledgeable audience.

In this blog, we’re going to take a deep dive into the skincare industry and how to build a beauty brand that outlives competitors. Let’s begin!

Why is the skincare industry having a moment?

The skincare industry has traditionally lived under the wider cosmetics umbrella. But seismic changes within the beauty industry have paved the way for skincare to emerge as a market segment in its own right.

In the United States, skincare sales have also been climbing steadily, and are forecast to hit $22.7 billion annually, opens in new tab by 2025.

And according to Tracksuit’s data, the number of people who've purchased skincare products in the last 6 months in Australia has grown from 7.3 million in November 2021 to 7.8 million in February 2023.

So, what’s behind the meteoric rise of the skincare market?

Self-care goes mainstream 💅

Rather than focusing just on the benefits of looking good, skincare branding is far more than skin-deep.

Where makeup is viewed as enhancement, skincare is an investment—and this framing gives brands a natural advantage when it comes to growth.

Brands, influencers, and medical experts are aligned in reminding customers that skin is their largest organ and worth protecting against the ravages of pollution, UV rays, stress, and even their own makeup.

This messaging proved especially effective during the COVID-19 pandemic. Weekly makeup-wearing fell by almost a third, opens in new tab YOY during 2020, while self-care categories including skincare, aromatherapy, and haircare saw a YOY increase of 300%, opens in new tab, according to data shared by McKinsey.

As the world adjusts to a “new normal” after the pandemic, consumers are continuing to hold onto the importance of wellness. The power of ritual and routine is a natural tool for people to counteract an uncertain world - and for brands to establish strong retention patterns that boost CLV.

Gen Z + TikTok + authenticity = the skincare trifecta 🧴

Many elder Millennials will remember (and cringe) at their teenage days of Clearasil and Neutrogena facewash plucked from the supermarket shelf. Thanks to growing up with social media in their back pocket, Gen Z consumers are highly educated on taking care of their skin, and they want sophisticated products to match.

But rather than gravitating toward the heavy-handed filters of Instagram, Gen Z have proven themselves as pioneers of self-acceptance. Their platform of choice? TikTok.

The video platform’s irreverence and quirky humor are a magnet for Gen Z globally, and in turn for their favorite skincare brands. CeraVe, The Ordinary, and Olaplex are just some of the brands that are regularly racking up millions of views via educational content.

This pairing of “skinimalism” with a desire for authenticity is no coincidence. According to Shelley Haus, opens in new tab, Chief Marketing Officer at Ulta Beauty: “People want to show their skin, freckles, and textures and are ok with not airbrushing over.”

With realness and experimentation now the flavor of the day, it’s not surprising that skincare is a core tool in the arsenal for Gen Z and younger Millennials.

Bondi Sands Chief Marketing Officer Alexandra Peek, opens in new tab says Bondi Sands has a strategic focus on TikTok to drive awareness and consideration of their skincare range. They decided to create new social channels for their facial skincare category on Instagram and TikTok separate from the main account, which is focused on self tanning and suncare products. The unique skincare accounts allows the brand to focus on delivering highly engaging and educational skincare content that skin customers are looking for, rather than trying to balance this with the other categories.

“Any beauty customer knows TikTok is where it’s at in terms of brand and product discovery and real reviews," Alexandra says. “You get skincare junkies who only want to see skincare content, so we created a separate channel that allows us to focus solely on the category, educate customers on new products, show befores and afters and focus on real skin. It’s a unique space to fully highlight that.”

She says Bondi Sands has experienced virality, opens in new tab on the platform with some of its skincare products, including its Eye Spy product, which has the instant gratification of a very clear before/after contrast when the product has been applied. Overall, TikTok has helped Bondi Sands drive demand and validated its decision to move into the skincare industry.

“We see ourselves moving towards being a skin health brand and skincare is that natural next step for us, particularly with that Gen Z and Millennial audience that are skincare obsessed,” Alexandra says.

Multi-brand beauty retail flexing its influence 💪

Storefronts like Sephora and Mecca offer beauty lovers an unrivalled gateway to product and brand discovery. Through brand spotlights, exclusive events, and trend alerts, these retailers frequently set the pulse for what brands and products develop cult followings.

To build a reliable conveyer belt of independent brands for their portfolio, Sephora launched its Accelerate incubator program in 2015. Up-and-coming skincare brands have been a consistent feature in Accelerate, including Mango People, Topicals, and Eadem. As well as keeping Sephora relevant, this has also served to increase the breadth and depth of the skincare market, especially in niche categories such as eco-friendly and BIPOC-owned brands.

What’s next for skincare?

Now that we’ve explored the trends behind the industry’s growth, let’s look at some of the innovations happening in the skincare realm.

Subscription services 📦

Skincare is naturally compatible with a subscription business model. Consumers need regular replenishments of their favorite products to maintain routines. So, giving them the ability to turn a one-off purchase into a recurring subscription is a massive value-add.

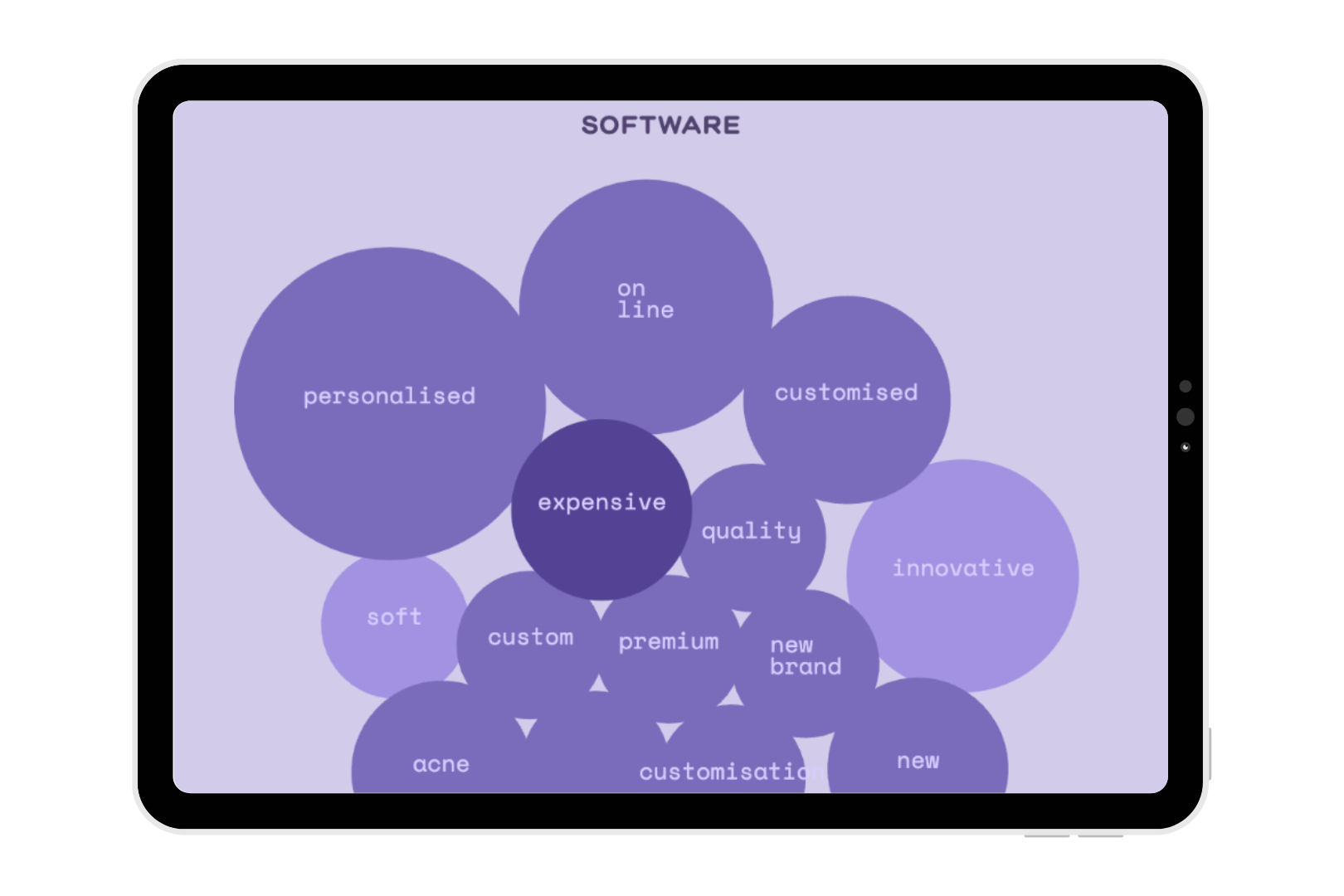

Australian skincare brand Software has taken this concept a step further by bringing together a subscription model with a prescription system. Its products are custom-formulated by dermatologists for customers’ unique skincare concerns and shipped to them on a two-monthly basis. This combination of convenience and hyper-personalization has enabled Software to carve out a unique proposition within a saturated market:

Sustainable — but with a difference ♻️

The rise of skincare has gone hand in hand with the growing demand for sustainable beauty. The organic and natural beauty product market is estimated to be worth $54 billion in 2027, opens in new tab, while 64% of consumers, opens in new tab surveyed by The Benchmarking Company in 2022 said that sustainability is very important to them when considering beauty products.

As more brands seek to align themselves with so-called “clean” beauty, brand positioning is increasingly important to gain market share and form lucrative partnerships that spread brand awareness.

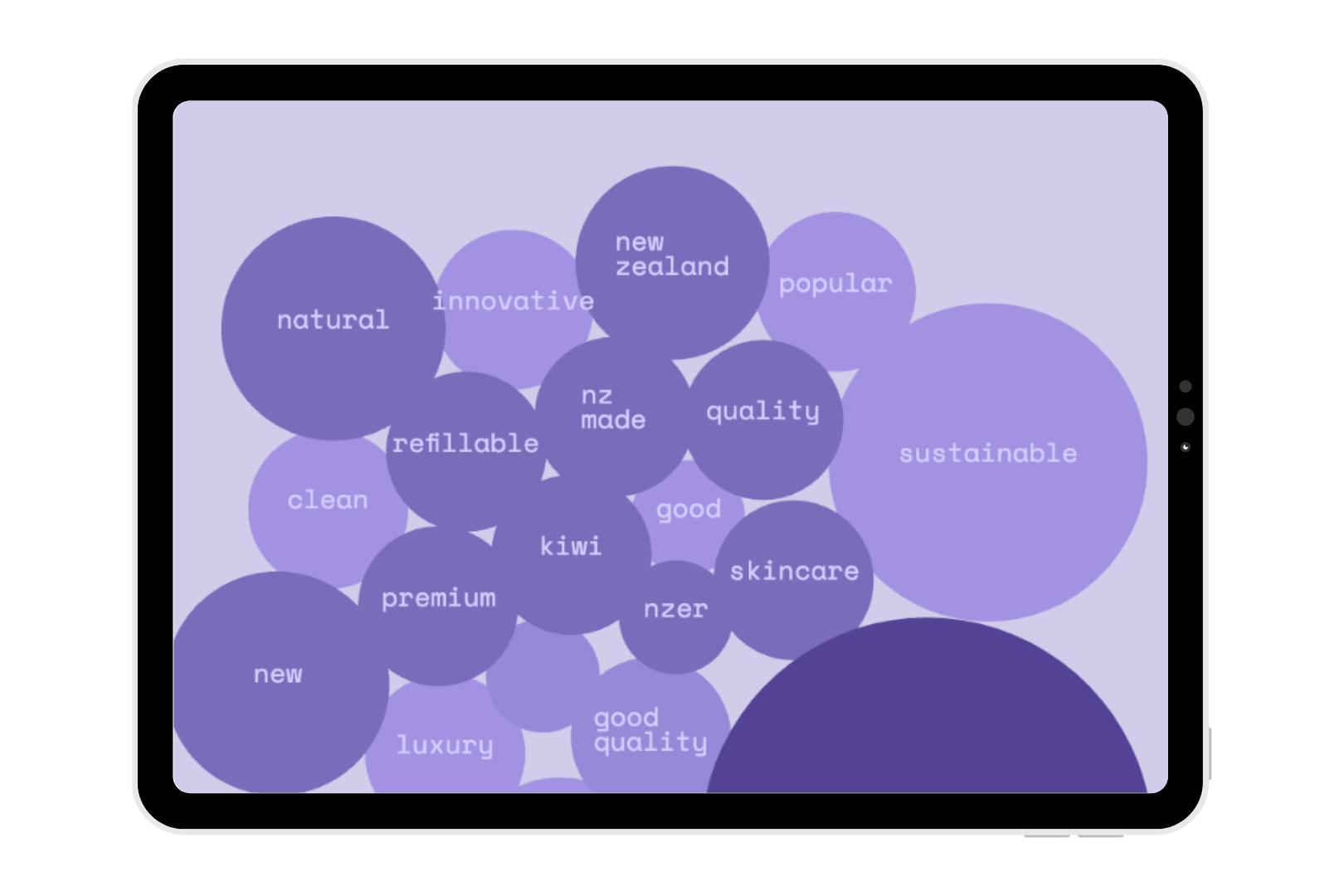

One of the biggest New Zealand skincare brands to be stocked at Mecca NZ storefronts, Emma Lewisham has carved out a successful niche as a pioneer of high-end, sustainable skincare. Emma Lewisham’s brand associations reflect this careful positioning, with Australian consumers viewing the brand as both “natural” and “sustainable” as well as “luxury” and “quality”.

Subscribe to Shorts (that's our monthly newsletter!)

Get insights, stories and goodness from the world of brand that'll help you win.

Loyalty programs 💜

Rewards programs must move beyond the classic “earn it and burn it” incentives if skincare brands going to build long-term purchasing habits in their customers.

Bondi Sands is one brand that has elevated its loyalty program beyond simple discounts. Its tiered program offers escalating benefits based on annual spending, such as free shipping, exclusive sales, and even priority access to new products. Shoppers can also earn points for one-off activities, such as leaving reviews, following them on TikTok, and signing up for SMS:

With cosmetics industry heavyweights like Sephora attracting high engagement with their own programs, independent brands need to introduce genuinely useful rewards to secure direct sales and bolster their marketing efforts.

Community-led storytelling 🤳

The COVID-19 pandemic gave consumers more time than ever to explore and research new products, and this newfound engagement has paid dividends for skincare brands that put their customer front and center.

Frank Body started out with a compelling product, but it’s the personification of its brand and product as a character that’s enabled it to develop a cult following. “Frank” is a suggestive, sweet-talking guy who is “different from other men” and has a devoted fanbase of over 6 million “babes”. The brand has nearly 800K followers on Instagram, while videos tagged with #thefrankeffect regularly break 50K in views.

As the skincare industry evolves, brands will need to think beyond pure product marketing if they’re going to strike a chord with their audience. This clever, quirky mode of skincare advertising has allowed Frank Body is stand out in a space where discussions focus more on science and benefits.

Popular skincare branding strategies (and why brands use them)

In the highly competitive skincare industry, branding plays a crucial role in building recognition, loyalty, and sales. Skincare brands employ various branding strategies to differentiate themselves from their competitors, attract customers, and build a strong brand identity.

Consider the following.

Sustainability 🌳

These days, it’s almost impossible to talk about skincare without mentioning sustainability. Growing numbers of consumers have an expectation that their skincare products don’t do harm to themselves or the planet, and they want reassurance that skincare brands have this in their DNA.

As well as being vegan and cruelty-free, Activist Skincare has baked the idea of circular beauty into the design of its products, which are 100% refillable. Its social channels are a place for education as well as promotion, with Activist Skincare providing in-depth statistics backing up their strategy to reduce their carbon footprint further.

Backed by science 🔬

As consumers or “skintellectuals” become increasingly educated on skincare formulations and ingredients, brands are under more scrutiny than ever before about what goes into their products and why.

This has led to the rise of “skincare as science” and more brands emphasizing their credentials as safe, effective, and honest manufacturers.

The Ordinary has built a cult following through its focus on single-ingredient skincare. Its tagline “clinical formulations with integrity” sums up its commitment to rejecting unnecessary additions to products, like coloring and perfumes. Many products are designed to be mixed with shoppers’ favorite serums or moisturizers, empowering consumers to become their very own dermatologists.

Inclusivity 🫂

To Gen Z and Millennial beauty lovers, inclusivity and diversity is no longer optional. The push for brands to cater to all skin types, ages, ethnicities, and gender identities has resulted in lucrative opportunities for brands that are willing to cater to underserved markets.

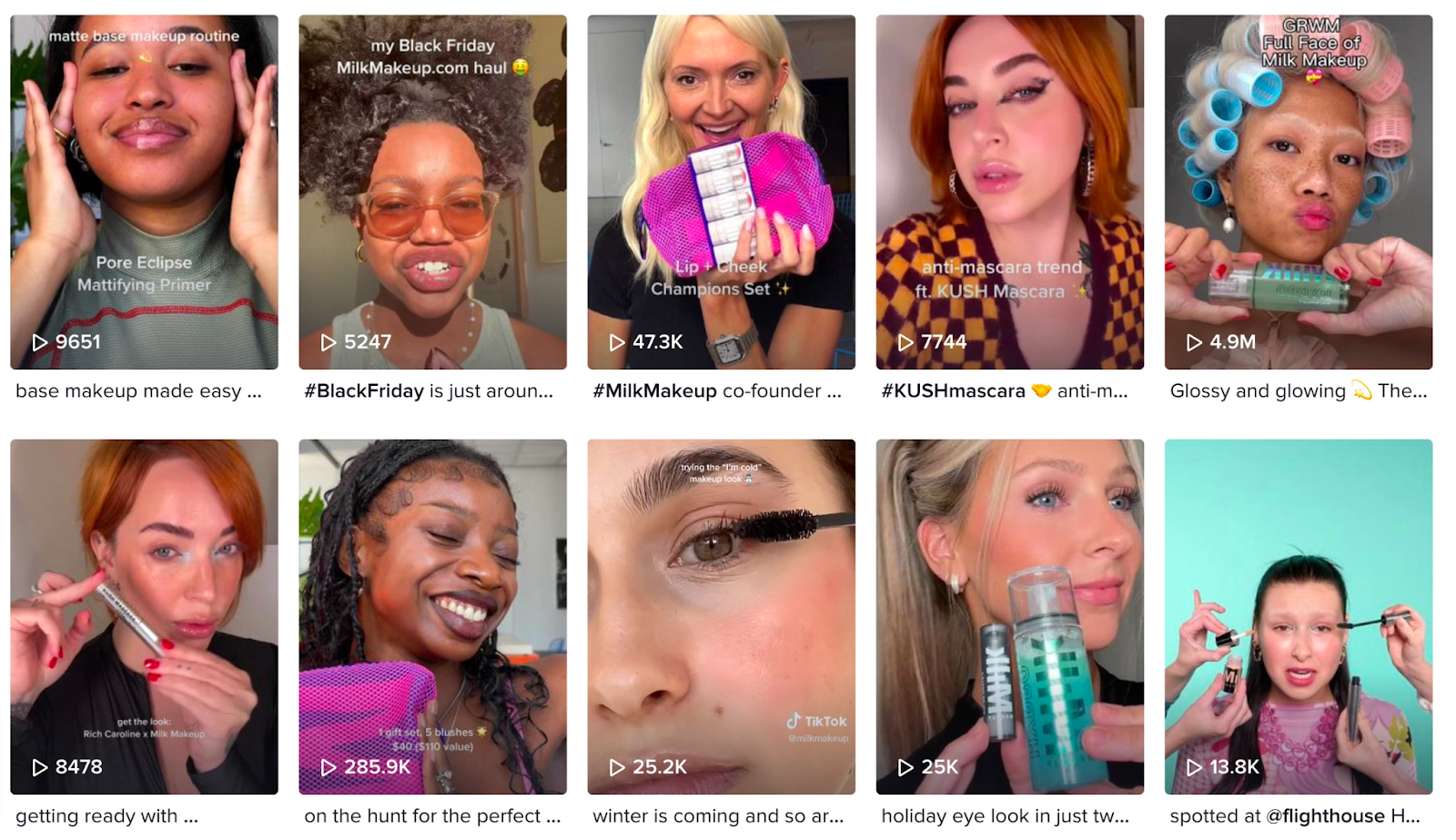

Milk Makeup originally started as a lifestyle brand focused on diversity and freedom of expression, but evolved into a cosmetics and skincare brand specializing in low-maintenance, intuitive products for every beauty lover. Its social media feeds rely on user-generated content, showcasing how their fans use their favorite products to achieve unique looks:

Wellness 💆

As we mentioned near the start of this article, wellness and self-care have become big business. Messaging that encourages consumers to invest in their well-being is an easy sell during a time of uncertainty and change.

Korean skincare brand Glow Recipe have tuned into that trend while customers want tangible results from their products, they also want the experience of using them to be fun and enjoyable. Their colorful “fruit-forward” aesthetic enables the brand to stand out in the industry shift towards more clinical messaging, which has helped them build a passionate “glow gang” that loves their feel-good branding.

Minimalism 💁

Minimalism has been a popular strategy in beauty branding as companies strive to let their products take center stage, as opposed to celebrity endorsements or in-your-face logos.

Skincare brands in particular have used this unbranding approach to build trust with consumers. Plain packaging, easy-to-read fonts, and minimal text all serve to reassure customers that a product is approachable and trustworthy, especially if a brand is new to the skincare space.

After a soft launch of select skincare products in 2015, e.l.f cosmetics officially launched the e.l.f skincare portfolio in 2022. To differentiate these products from its more colorful cosmetics collection, e.l.f has opted for a paired-back design that emphasizes ingredients and benefits:

The finishing line 🏁

The skincare industry is clearly on the up, and emerging brands will need to think carefully about how to position their brand and stand out within a highly competitive beauty market.

So, how do you know if your awareness and positioning efforts are working? By using a brand tracking platform like Tracksuit. We give skincare brands like Bondi Sands, Frank Body and Emma Lewisham real-time insights into what consumers think about their brand and their competitors so that they can make data-driven decisions about their branding and marketing strategies.

Bondi Sands CMO Alexandra Peek says Tracksuit has helped their marketing team validate their assumptions, which is important because brand awareness can be hard to prove and articulate to the wider business.

"As a global business, we want to be able to capture all markets and have a consolidated view of the business. Tracksuit allows us to have that visibility in an effortless way to digest and share with the wider team," she says. "There's always going to be people that want more information on certain areas, and we can easily do that with a few clicks, or you can send out a more top-level report, and people can understand it."

In terms of favourite features, Alex is a big fan of the Imagery tab on the Tracksuit dashboard.

"We really loved the brand word bubble associations, that was really interesting. We were surprised by the awareness of skincare in the Australian market, when we looked at the word associations we realized it’s the Bondi Sands brand they know – they most likely know us from self tanning or sun care, so it's a great opportunity that we can leverage. Now, we’re looking at how we can focus on the fact that we have a skincare range, not just the other two categories," she says.

"Tracksuit is the most user friendly brand tracking. It is designed for the marketer."