The dog days aren't over: 5 pet food trends shaping the industry

One thing is certain: furry friends and crawling critters have never been more in than the present. Chances are high that you can easily list off several friends and family members who are pet owners, but just how big is the pet market today?

It’s estimated that the global pet market reached an incredible $223 billion in 2021, and is projected to reach $325 billion by 2028. The rapid growth in the industry can be traced back to the COVID-19 pandemic, as it grew nearly 30% in 2020., opens in new tab

Sign up to Shorts

For fortnightly brand insights, stories and goodness that'll help you win (we promise).

Tracksuit’s data shows that in the United States, there are 148.4 million active consumers of pet food as of April 2023 (or 59% of the population). In New Zealand, there are 2.1 million people buying pet food (57% of the population).

In Australia, there are 8.8 million active consumers of dog food (43% of the population). This has grown by 900,000 people since July 2022.

Understandably, other sectors within the industry have seen increased profits. Revenue in the pet food sector is estimated to reach $147 billion in the U.S., opens in new tab in 2023, and is valued at AUS $4.59 billion in Australia., opens in new tab As for the pet accessories market? $42.3 billion by 2026., opens in new tab

If your organization or brand is active in the pet market, it’s important that you stay abreast of the latest developments in the industry. By keeping your finger on the pulse of what’s going on, you can provide the best value to your customers and effectively manage your brand. Not sure where to begin?

In this article, we’re going to take a look at the 6 biggest trends in the pet market and pet food industry that you need to be aware of.

Millennials choosing pets over kids 👶

In recent years, there’s been a growing trend of DINK (double income, no kids) millennials opting to exclusively have pets instead of children. Many countries have seen a decline in birthrates: the U.S. hit an all-time low in 2020, opens in new tab, which was also seen in Australia in the same year., opens in new tab But as we just mentioned, the pet market is bigger than ever! This begs the question: why are the furry members of the family…well, the only potential new addition to the family for many?

The answer is multi-faceted, but there are a few key factors that play a role. First, it’s important to get one thing out of the way: many Millennials see their pet on the same level as a child: they’re not just a “pet parent,” they are parents. With that said, here are some of the reasons why pet ownership has become increasingly popular among millennials and Gen Z’ers.

First, there’s the lower costs. While having a pet can be somewhat pricey — ranging as high as $1,100, per the ASPCA, opens in new tab — that’s nowhere near the USDA estimate of as high as $17,375 a year for a child., opens in new tab Simply put, (DINK) millennials can easily splurge on their pet by buying them premium pet food products and giving them regular pamper sessions and come nowhere near the same costs of having a child.

Then there’s also the broader socio-economic issues: the pandemic made many people realize that perhaps they didn’t want to raise a child in this society. Plus, sustainability issues like climate change or overpopulation may play a factor in their decisions as well.

Another factor can be the need for freedom and responsibility: it’s easier to travel the world or stay out late as a cat or dog owner, and it’s often less hassle to find someone to take care of a pet for a while. With a pet, improving your mental health wellness is possible without as much commitment as having a child.

Finally, the biggest reason is perhaps the most simple of all: according to a survey of 400 millennial women,, opens in new tab the biggest reason for not having a child was that they simply didn’t want to — and frankly, that’s as good of a reason as any, as far as we’re concerned.

The rise of pet food subscription services 📦

During the peak of the pandemic, the relatively newer phenomenon of pet food subscriptions started to dominate the industry. Although D2C pet sales were already taking hold in the pet ecommerce market, it wasn’t until COVID-19 that things really kicked off for the subscriptions, as pet owners dealt with lockdowns and stay at home orders.

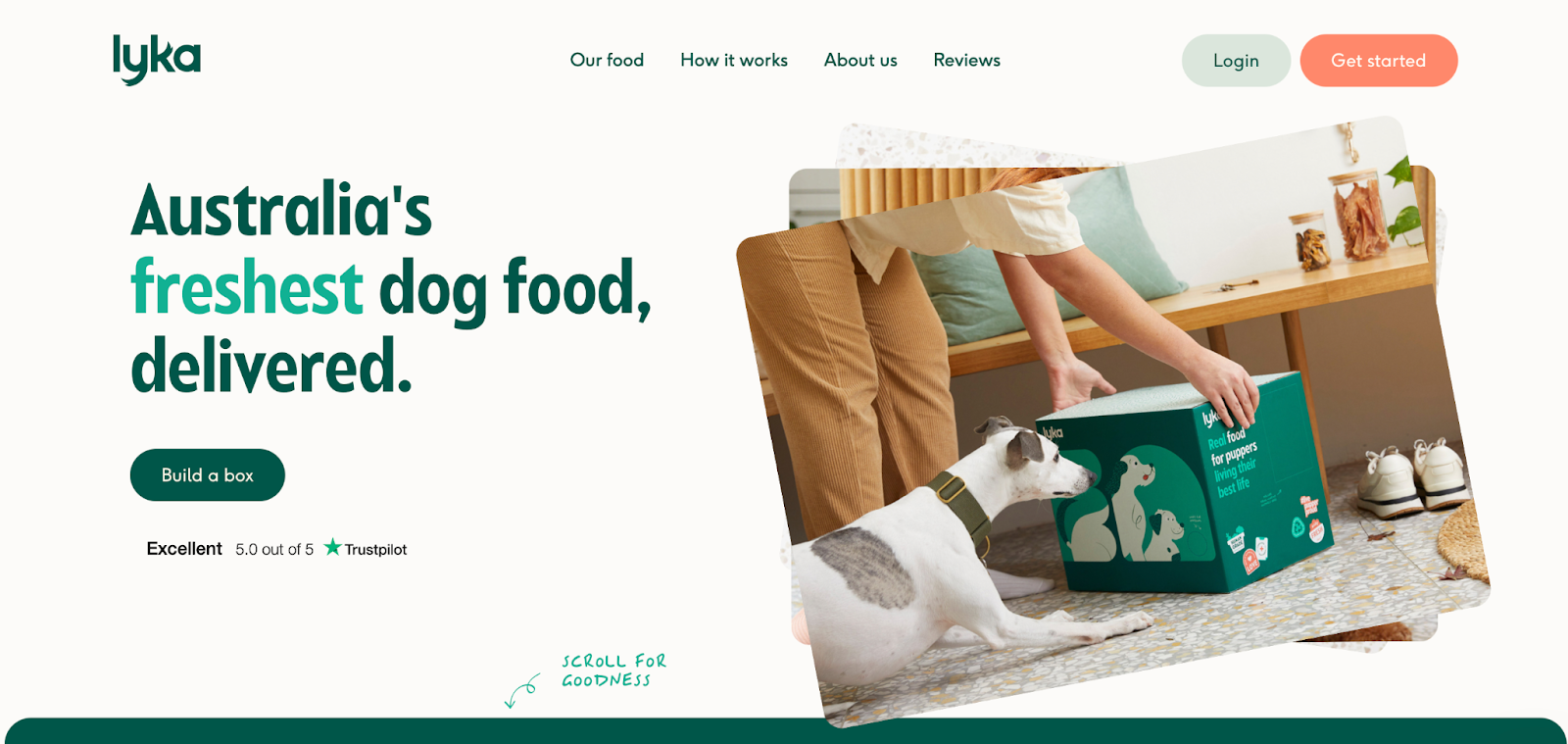

Pet food companies like Lyka, opens in new tab in Australia, for example, offer custom-tailored meal plans for pets, and then deliver pre-portioned meals straight to your door. Think HelloFresh for pets. This has led to Lyka being seen by consumers as ‘unique’ and ‘innovative’, as per their Imagery data on the Tracksuit app.

The increased humanization of pets has led to a sizable market for pet meal kit deliveries, which is expected to grow from $2.2 billion in 2020 to just over $9 billion in 2030., opens in new tab With this sharp increase in subscription services providers, pet food manufacturers are providing higher-quality food for animals, as pet owners are increasingly expecting the same level of quality for their furry babies as they do for themselves.

For example, there’s non-GMO dry food, grain-free dog food, or pet food made with alternative proteins (e.g. plant-based ingredients) — all of which aim to provide various health benefits for pets.

But by far the biggest advantage of pet food subscriptions is its convenience: no need to go pick up food in-store or bother with portioning it out. However, it does cost more than the traditional way of getting pet food, clocking in as high as $325, opens in new tab a month.

Growth of luxury pet products and accessories 🐾

We mentioned in the first point that it’s not uncommon for pet owners to see their pets on the same level as kids. It’s then logical that they’d pamper and spoil them the same way parents would do with their kids, right?

In the United Kingdom, pet owners shell out $654, opens in new tab a year on luxury treats and toys — which is understandable when luxury companies like Prada, opens in new tab or Gucci, opens in new tab sell a wide range of fashionable pet accessories.

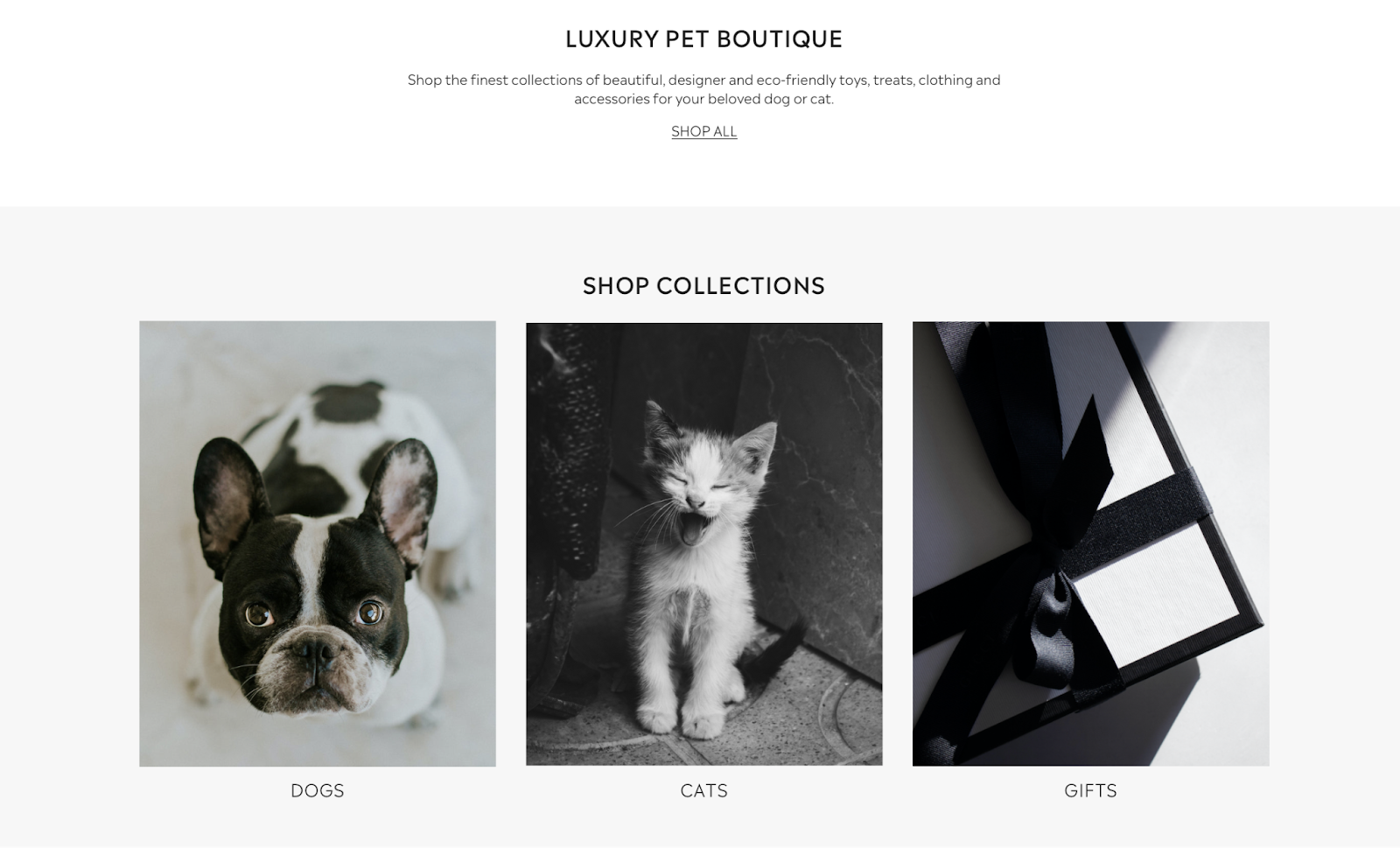

Within the United States, sales of pet supplies notched $4.54 billion, opens in new tab, and that number is likely to only keep increasing., opens in new tab There’s also been an uptick in smaller, boutique companies that sell these products, like the brand Charli & Coco., opens in new tab

For pet owners that prefer to shop local, options like these are increasingly becoming the preferred choice. And with more millennials and Gen Z’ers becoming pet parents, it’s certain that a significant number of them will hop aboard the luxury pet product and accessories trend — a great opportunity for pet care brands to capitalize on.

Personalized pet products 🐶

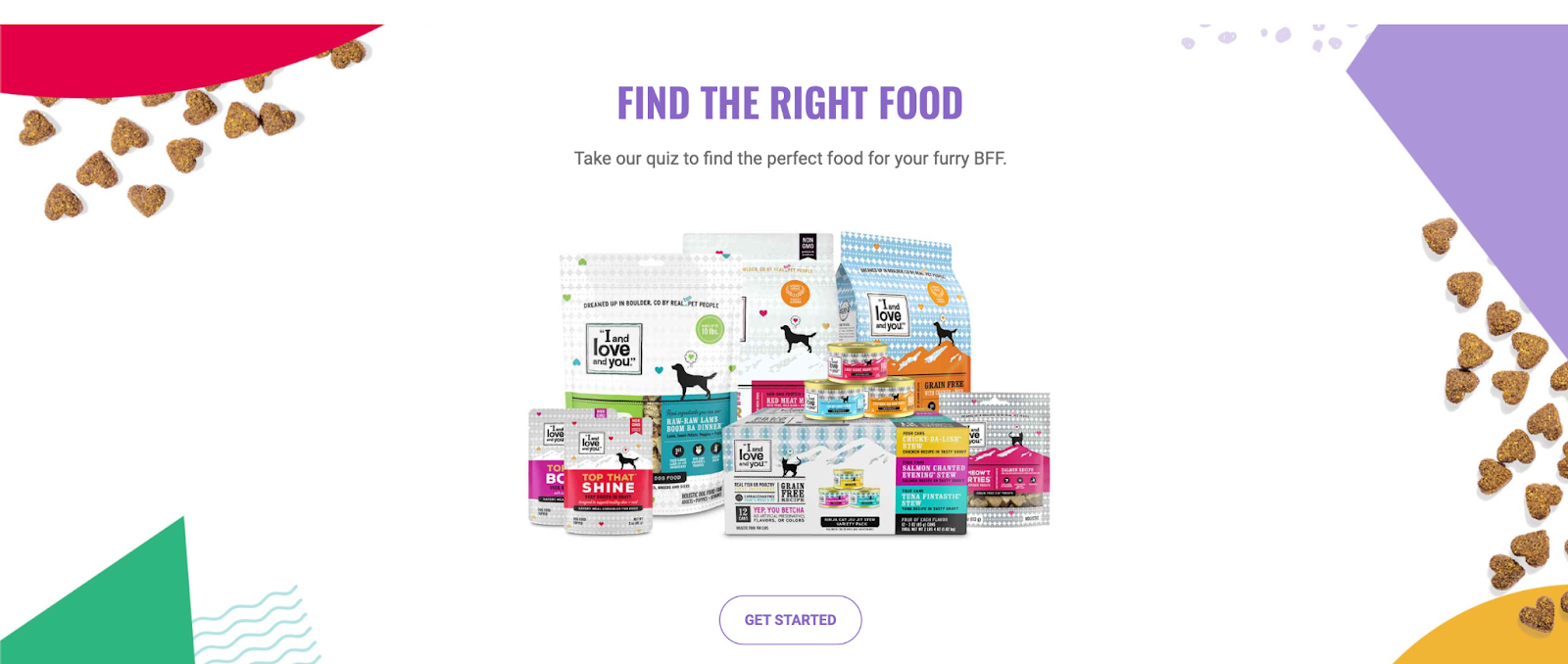

Another way that pet parents love to show their affection and care for their little family members is by purchasing personalized or one-of-a-kind products. For example, there’s an increased interest in Gen Z’ers purchasing personalized pet food — with 90% of respondents, opens in new tab saying their dog’s personal food preference is the key factor in determining what pet food they opt for.

We personally love how I and Love and You’s brand offers customers a quick quiz, opens in new tab to help them find the right pet food specific to their situation.

But whether it’s personalized pet food, gifts, or accessories, one thing is certain: pet owners are shifting away from a “one size fits all” approach, which means pet market brands need to increasingly focus on deep personalization if they want to truly resonate with their target audience and ensure stellar brand health., opens in new tab

The rise of pet technology 🤖

While dogs and cats may not need the services of ChatGPT just yet, the robot revolution has come to the pet industry, albeit on a smaller scale. Recently, there’s been an increase in pet technology across the market, as consumers find different ways to integrate smart tech into their lives to make taking care of their beloved family members more easily.

One of the most popular smart pet gadgets on the market is the PetCube, a 2-in-1 device that’s both a security camera and treat dispenser. There also smart location trackers so you can keep track of your pets as they roam outside, smart feeders so you can be sure your pets have enough food when you’re away for the weekend (while tracking their calorie intake or adjusting their feeding schedule), and even litter robots, opens in new tab that ensure you’ll never have to scoop up cat litter again.

As pet technology continues to rapidly develop, it’s likely that we’ll see even more state-of-the-art developments in the upcoming years — especially as it’s estimated to reach AU $15.9 billion by 2026., opens in new tab

The focus on health and wellness pet products 🐈

Just like many of us pop the regular supplement or vitamin, we’re seeing an increase in pet owners that want to take care of their pet’s health as much as possible (likely in part driven by the pandemic, which drove some pet owners to start taking their pets’ immune health more seriously.) It’s also reflected in the marketing and communication in the pet market, which will have a global market share of US$3.2 billion by 2028., opens in new tab

Health and wellness products for pets is a quite broad field, and can include products like doggy multivitamins or pet probiotics. The latter, for example, skyrocketed between 2019 to 2020, with digestive health pet supplement claims rising by 173%., opens in new tab However, it’s important to note that pet owners don’t just expect generic pet multivitamins: there’s a focus on using natural ingredients, and more recently we’re seeing a spike in interest in CBD pet products as well., opens in new tab

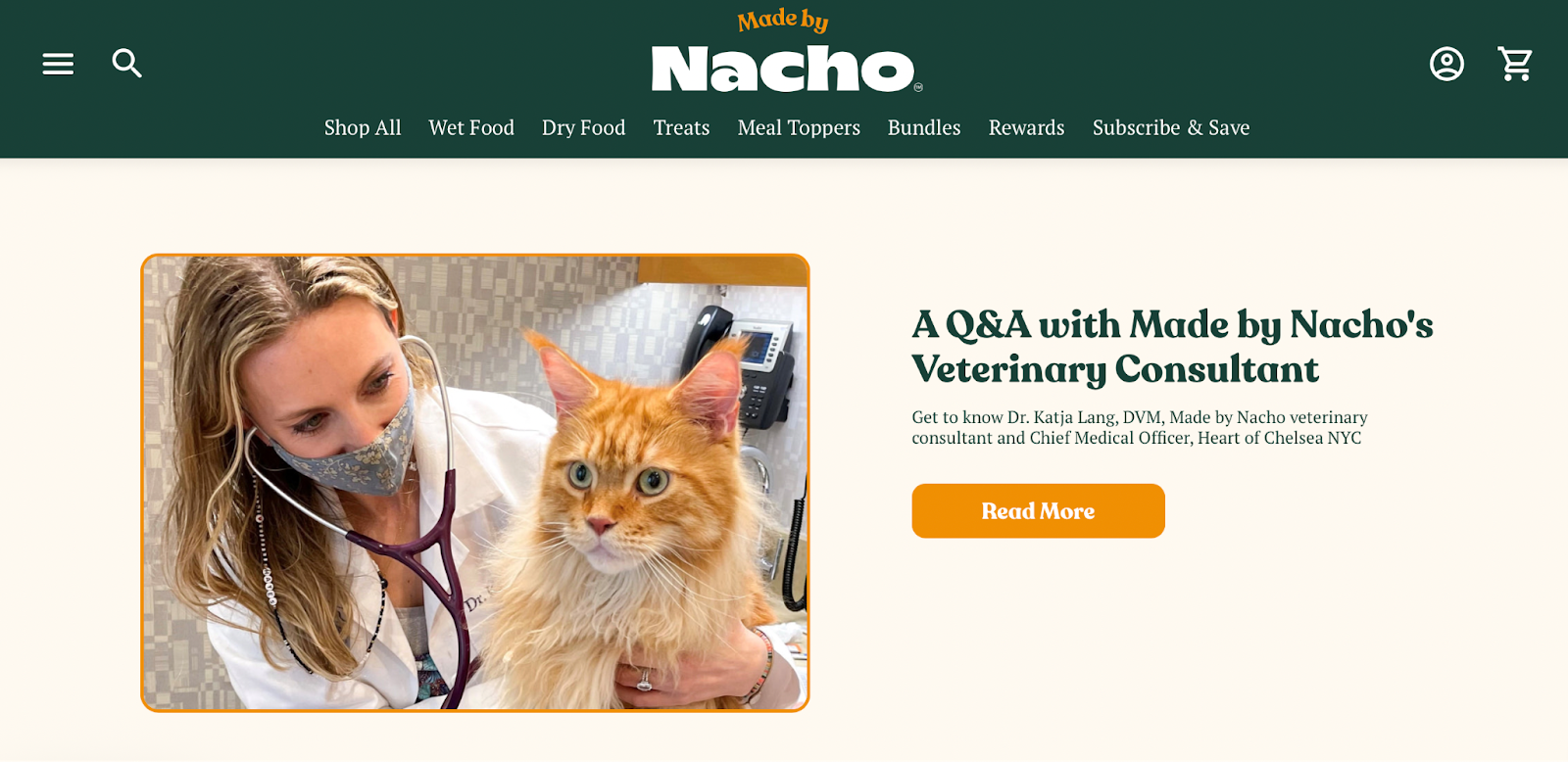

Pet owners may also appreciate helpful wellness tips and information, so it pays to educate your customers on how to improve the wellness of their pets. Take, for example, Made by Nacho playbook, which has a wellness blog for cat owners, opens in new tab

This ensures the brand is speaking directly to the 86.6 million active consumers in the cat food category in the United States (which is 34% of the population!) and addressing their concerns and pain points about their beloved felines.

From skin balms to water additives to dental care wipes, the range of products available for pet owners to use on their pets continues to expand. As this is a rapidly shifting market with consumer preferences constantly evolving, it’s critical that pet brands keep a close eye on what their consumers want to stay relevant.

The finishing line 🏁

So, what have we looked at when it comes to trends in the pet industry?

- In many countries, birthrates have reached an all-time low while the pet market is bigger than ever, which means Millennials and Gen Z’ers are choosing pets over kids.

- Thanks to the pandemic, we’re seeing a sharp increase in pet food subscription services that provide higher-quality food options and extra convenience for owners — but at steeper prices.

- Luxury pet products and accessories are on the rise, and more discerning consumers prefer to purchase from smaller, locally-owned pet brands.

- A “one size fits all” approach doesn’t work anymore, as pet owners expect personalized products for their furry family members.

- Smart pet technology — like litter robots or smart feeders — are increasingly popular.

- Pet owners are increasingly focused on their pets’ diets, and regularly purchase a variety of health and wellness pet supplements.

Now that you’re equipped with the latest knowledge of the trends shaping the pet industry, how can you make sure the hard effort you’re about to put in will actually pay off? After all, you need to have an effective brand tracking strategy in place to ensure your strategic planning is actually resonating with your customers.

At Tracksuit, we provide brands with real-time and actionable brand insights by clearly showing you what consumers think about your brand. Basically, we skip the vague terminology and vanity metrics to focus on injecting your brand with immediate, long-term value.

Even though the pet market and ecommerce at large might constantly evolve, solid brands will always need strong brand marketing and tracking to succeed in today’s landscape. That’s a fact.

Discover how your brand performs against others in the pet market and start growing your brand today by requesting a demo.