The biggest brand moments of 2023, according to consumers

What marketing moments dominated the public consciousness in 2023?

We surveyed nearly 20K consumers across the US, UK, AU and NZ, asking them: Which of the following entertainment or consumer events did you see or hear the most about in 2023? (AKA, great marketing!)

When we compiled the results of all four markets, unsurprisingly, the Barbie film came out on top as the most prominent entertainment or consumer event, capturing a major share of the vote (20 to 30%) of respondents in every market (30% in the US, 28% in the UK, 21% in AU and 20% in NZ).

Sign up to Shorts

For fortnightly brand insights, stories and goodness that'll help you win (we promise).

The Barbie film grossed an eye-watering $1.4B at the box office worldwide, while the commercial impact was felt in the toy aisle, too: Barbie parent company Mattel reported a 14% increase in doll sales in October after the film was released.

We’ve done our fair share of analysis on the Barbie film campaign already (check out our case study, how brand Barbie is a masterclass in reinvention) but up-to-date data shows that as of January, Barbie’s brand awareness is up 3% (4.5M) in the States and usage is up 4% (5.4M) since August 2023.

The second biggest brand moment was the Taylor Swift world tour and film, which resonated deeply with consumers and claimed 8 to 25% of their votes across four markets. In other words: it’s impossible to ignore the massive cultural and economic impact of Taylor Swift.

2023’s Swiftmania was kicked off by her hugely popular Eras concert tour and film launch and culminated in Taylor being named Person of the Year, opens in new tab by Time Magazine at the end of 2023.

Data from Pollstar reveals the tour has grossed over $1 billion USD, which makes it the highest-earning concert tour of all time.

Tracksuit’s data shows that Taylor Swift has 89% brand awareness in the United States, 48% consideration, 43% usage and 18% preference – the highest brand metrics out of any pop star that we track. Her cultural impact travels far and wide beyond music, too: her relationship with Travis Kelcey reportedly drew an additional 2 million female viewers, opens in new tab into the Sunday Night Football NFL game. More on that to come 👀

The third most popular brand moment of 2023 was the Women’s FIFA World Cup, which captured 4 to 32% of the votes across the four regions.

This comes as no surprise, as the Women’s FIFA World Cup hosted by Australia and New Zealand was the most attended women’s sporting event of all time – truly major.

Football fever helped Australia’s national team, The Matilda’s (affectionately known as ‘The Tillies’) break TV viewing records. Their semi-final match against England was crowned the most watched TV show in Australia’s history,, opens in new tab drawing in 11.15 million viewers at its peak. That figure also doesn’t include the tens of thousands of people that packed into the streets and stadiums to watch the game, either.

This World Cup also marked the first time that brands could partner with just the women’s tournament (rather than being bundled in with both the men and women’s tournaments).

Tracksuit’s survey of 4000 Aussies found that 42% of consumers were more likely to purchase from a brand that actively promotes and supports womenʼs sports, opens in new tab over brands that don’t.

Men also got behind women’s sports in a big way – our survey found that 45% of men are more likely to purchase from a brand-backing female sport compared to 39% of women. Brands such as Unilever, Nike, Hyundai and Commonwealth Bank, who sponsored the event and its team, can feel validated in their decision to partner with such a successful event.

What unites these biggest brand moments?

Because of the culmination of many trends originating from girlhood (Barbie, Taylor Swift, girl math, girl dinner) 2023 was dubbed by multiple outlets as ‘The year of the girl’, opens in new tab

While all of the top three marketing moments of 2023 have fandoms powered in large part by women (who also hold a huge amount of buying power and economic influence, opens in new tab in society) they were by no means exclusive to an all women audience, and managed to transcend and unite people across different ages, genders and geographies.

The marketing campaigns that fuelled these three major moments gave everyone the permission to delight in products, experiences and behaviors previously reserved for girls.

This was perhaps best illustrated by the groups of male friends getting together to go down and watch Matilda’s games at the local pub in Australia. In the United States, people of all ages and genders could engage with a range of product partnerships by Barbie that included a luggage line with Beis Travel, opens in new tab, Pinkberry’s Barbie frozen yogurt, opens in new tab, and the Barbie dream car in the Forza Horizon 5 video game, opens in new tab

By using a marketing strategy that was centered around creativity, humanity and joy (such as Barbie playing into the key theme of nostalgia for older consumers who relate the doll to childhood) these marketing moments tapped into a need for escapism. In a world which was facing an economic downturn and political unrest, it was the perfect anecdote.

As well as this, by targeting widely with their brand building, Barbie, Taylor Swift and the Women’s FIFA World Cup changed the narrative and created a new generation of fans to stand alongside pre-existing ones through the smart use of community, brand partnerships and fan engagement online and offline.

The collective momentum of these marketing campaigns drove hype over the long-term and built excitement before the events had even launched so by the time they did go live, demand from consumers was at a fever pitch.

“All three of these top brand moments will set the playbook for how effective marketing actually drives long-term value,” Tracksuit’s Head of Marketing Mikayla Hopkins told The Australian, opens in new tab.

“It’s really exciting to be able to pair that data with such strong brand-led activity, and I hope that gives marketers and other people – chief financial officers and the wider stakeholder group of a business – confidence that when you do build big, integrated campaigns, they truly make a difference on the bottom line.”

Read on for a more comprehensive break down of the results by region, gender and age, compiled by our wonderful Research team👇

When US consumers dished about what caught their attention the most in 2023, some interesting trends unfolded.

The Barbie film stole the show, with 30% of US consumers saying it was the event they saw or heard the most about in 2023. This was the highest percentage of consumers who ranked the Barbie event first out of the NZ, AU and US and UK markets. As for a demographic breakdown, women or those sitting within lower income brackets were significantly more likely to have seen or heard about the Barbie film.

The Taylor Swift world tour and film was not far behind in terms of popularity (25%), and the impact of this event again sat higher than in the other three markets. Women, people aged 65+, or those sitting within medium or higher income brackets were significantly more likely to have seen or heard about the buzz surrounding T Swift in the US.

Twitter's rebranding to X came in third (12%) which again was higher than the other three markets, while males in the US were significantly more likely to have seen or heard about the controversial rebrand.

Our friends in the UK saw and heard about slightly different major events than in the US, with more of an increased focus on sporting events.

The Barbie film once again took the winning spot (28%) surpassing the NZ and AU markets and sitting just below the US. Women or those aged between 18 to 34-years-old were significantly more likely to have seen or heard about the Barbie film.

The Women’s FIFA World Cup snagged second place (19%) sitting just above NZ and well ahead of the US. People aged 65+ in the UK were significantly more likely to have seen or heard about the Women’s FIFA World Cup. The England women’s team were runners up in the event and beaten out by Spain in the final.

Not far behind in third place was the Rugby World Cup (18%) which was well above the AU and US markets. This makes sense, given UK consumers were in closer proximity to where the event was hosted in France. Males, people aged 65+ or those sitting in higher income brackets were significantly more likely to have seen or heard about the 2023 Rugby World Cup.

Women’s football fever came out on top in Australia, as the 2023 Women’s FIFA World Cup captured the biggest portion of the vote and hugely surpassed the results of any other market (32%).

Australia was a host nation for the sporting event, but one interesting insight is this event didn’t just appeal to young women – males or those aged 35+ were significantly more likely to have seen or heard about the Women’s FIFA World Cup, which would be of interest to advertisers who supported the event and its teams.

The Barbie film came in second (21%), which was slightly higher than in NZ, but lower than in the US and UK. Women and those aged between 18 to 34 were significantly more likely to have seen or heard about the Barbie film.

The Taylor Swift world tour (and film) came in third at 14%. This was more impactful than in NZ and the UK, but much lower than the US. Similar to Barbie, women and those aged between 18–34-years-old were significantly more likely to have seen or heard about Taylor Swift’s world domination through her Eras concert tour and film.

New Zealand is known for being a rugby loving nation, and this was highlighted in the results of the biggest brand moments of 2023 survey. The 2023 Rugby World Cup took the top spot in terms of the event Kiwi consumers saw or heard the most about (38%), hugely surpassing the impact it had in the other three markets, despite being hosted across the world in FRance.

In second place was the Barbie film (20%) sitting just lower than across the ditch in Australia. Women or those aged 18 to 34-years-old in New Zealand were significantly more likely to have seen or heard about the Barbie film over the course of 2023.

Yet another sporting event took out the third top spot – the Women’s FIFA World Cup (17%). New Zealand was a host nation alongside Australia, and the event had far more impact in NZ than with consumers in the US, but was slightly lower than the UK.

When it came to a demographic breakdown, those aged 65+ were significantly more likely to have seen or heard about the Women's FIFA World Cup.

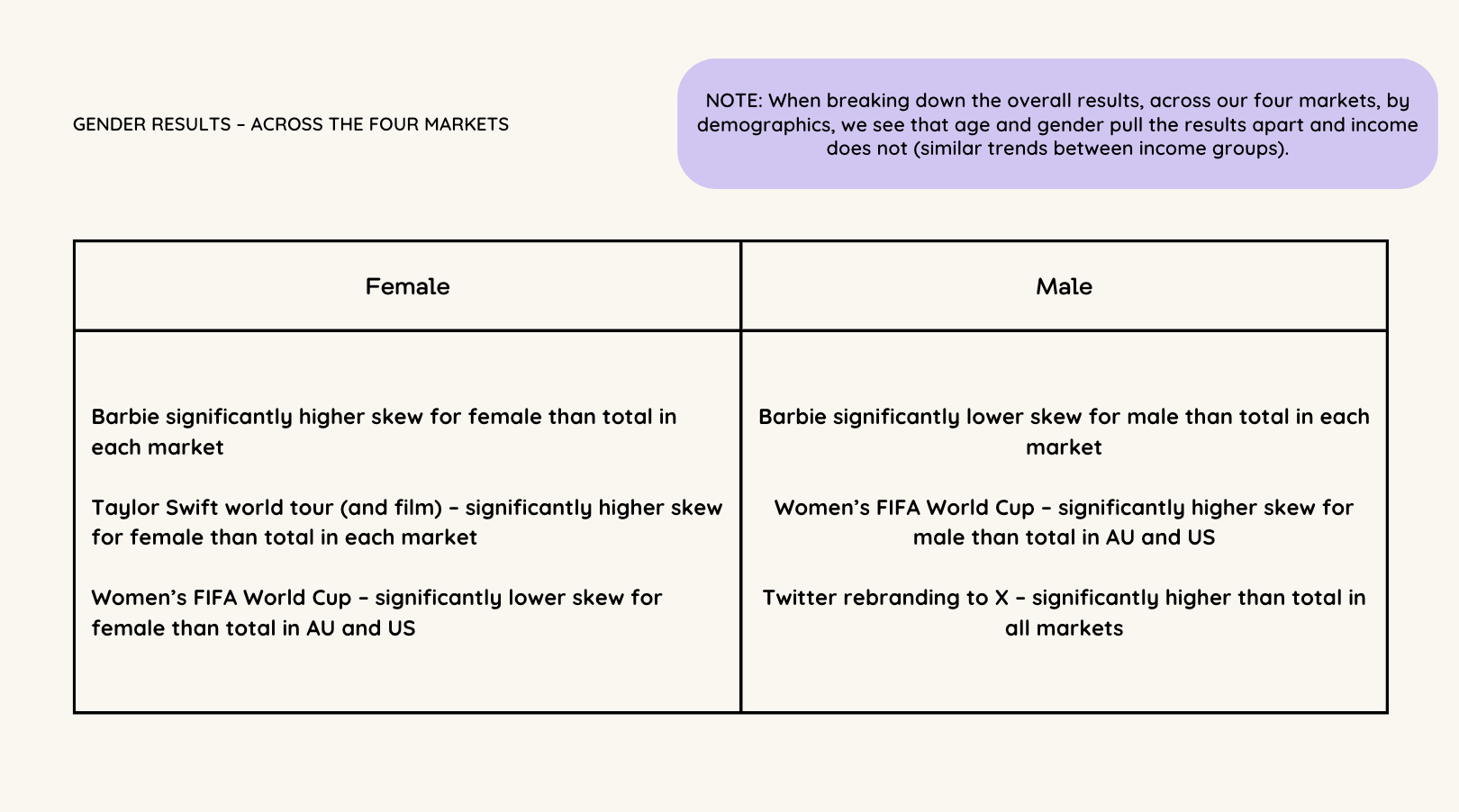

The biggest brand moments by gender

When we looked at the biggest brand moments for women cross-market, several trends emerged in 2023. The Barbie movie had a significant skew with females across all markets (26 to 37%), while the Taylor Swift world tour and film also gained a lot of attention from women compared to males across all markets (9 to 28%).

The Women's FIFA World Cup, on the other hand, captured 6 to 35% of the total male respondents, which was significantly higher than the total in Australia and the US. While they didn’t perform significantly higher in NZ (18%) and the UK (19%) compared to total, attention was still higher among males than females for this particular event.

As well as this, the Twitter rebranding to X brand moment was more favored among men, with 5 to 17% of the vote.

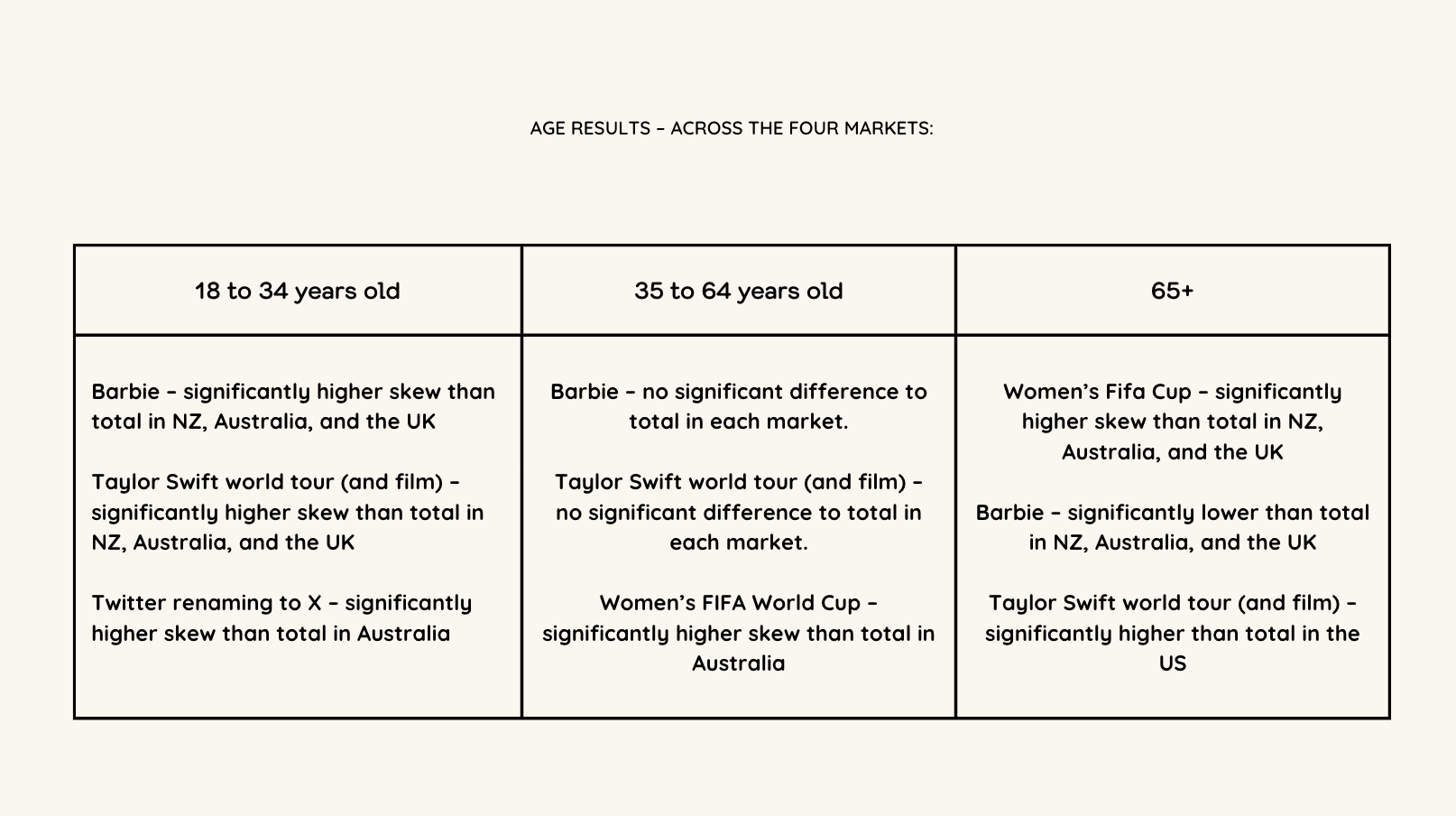

The biggest brand moments by age

Within the younger 18 to 34-year-old age group, Barbie gained between 27-38% attention, significantly surpassing the total in NZ (29%), Australia (27%) and the UK (38%).

Taylor Swift's world tour and film secured 11 to 20% of the vote, showing significantly higher skews compared to total in NZ (13%), Australia (19%) and the UK (11%). Although in the US, attention was the highest across the 4 markets (20%), this was significantly lower compared to the average in the States.

The Twitter rebranding to X captured 5 to 14% across the four markets, with a significantly higher skew compared to total in the Australian market (7%).

In the 35 to 64-year-old age group, Barbie maintained influence with the middle age group sitting between 18 to 29%, with no significant differences compared to the totals in each market.

Taylor Swift's world tour and film held steady between 6 to 27%, with no significant differences compared to the totals in each market.

The Women's FIFA Cup, however, garnered between 18 to 36% of people’s attention, with a significantly higher skew compared to the total in the Australian market (36%).

The Women's FIFA Cup gained prominence with those 65 years old and older sitting between 23-47%, with significantly higher skews compared to total in the NZ (23%), Australian (47%) and the UK (25%) markets.

Barbie, sitting between 8-30%, stood significantly lower than the total average in NZ (8%), Australian (14%) and the UK (17%) markets.Taylor Swift's world tour and film sitting between 1-30% showed a significant skew in the US (30%) market. However, in the NZ (1%), Australian (9%) and UK (3%) markets, these scores are sitting significantly lower than each market’s average.

The finishing line 🏁

We're excited to watch the biggest brand moments of 2024 unfold! We'd love to hear your predictions for what events will resonate with consumers the most this year – drop us a DM on Linkedin , opens in new tabif you have some ideas.

This is but a small snapshot of the power of Tracksuit’s market research and the insights we collect for brands. If you’d like to dig deeper into consumer perceptions and their assessment of your business, get in touch with one of our brand experts